Have you ever wondered how you could make your hard-earned money work even harder for you? Well, buckle up because, in today’s blog post, we’re diving deep into the world of investing in Canadian dividend stocks for passive income. Trust me, this is one financial journey you won’t want to miss out on!

What Are Canadian Dividend Stocks?

Before we dig into the benefits of Canadian dividend stocks, let’s take a moment to understand what they are. Canadian dividend stocks are shares of companies based in Canada that pay out a portion of their profits, called dividends, to their shareholders. These dividends can be a consistent stream of income and provide a regular paycheque for investors.

Why Invest in Canadian Dividend Stocks?

Now that we know what Canadian dividend stocks are, let’s talk about why they are a popular choice for investors. Here are some key benefits that make them worth considering:

Steady Income from Canadian Dividend Stocks

One of the most attractive aspects of investing in Canadian dividend stocks is the steady income they can provide. Instead of relying solely on the ups and downs of market prices, dividend stocks can offer you regular payments as long as you hold the shares. This means you can count on a paycheque from your investments, which can be especially appealing for those looking for regular cash flow.

Traditionally, dividends are paid quarterly (once every three months), but there are firms and dividend ETFs that have monthly payouts to help ease your cash flow.

A Hedge Against Market Volatility

The stock market can be a wild ride, with prices jumping up and down like a kangaroo on a trampoline. But fear not, my friends! Canadian dividend stocks have the potential to provide some stability in a volatile market. While stock prices may fluctuate, the dividends paid by these stocks can offer a degree of predictability and help cushion the blows during market downturns. It’s like having a financial safety net!

Long-Term Growth Potential

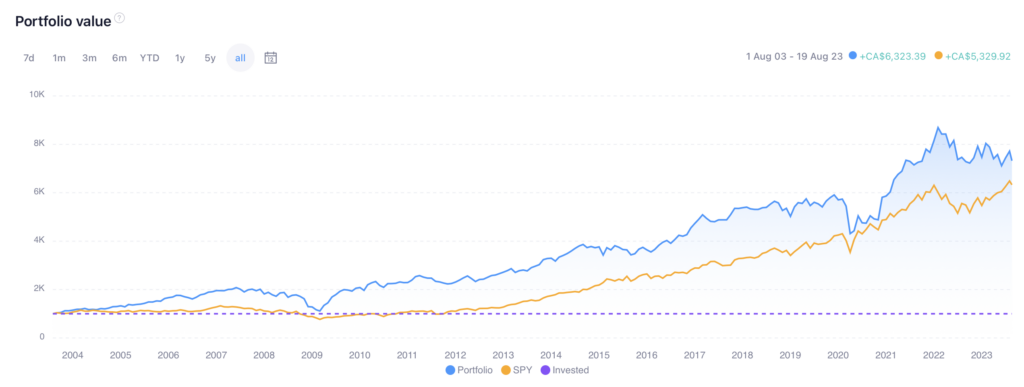

Investing in the right Canadian dividend stocks can also yield long-term growth. As you receive dividends over time, you can reinvest them back into more shares, compounding your returns. Additionally, many Canadian dividend stocks are found in solid, established companies that have a history of steady growth. So not only are you receiving income, but you also have the potential to see the value of your initial investment increase. Talk about a win-win situation!

Tax Advantages of Canadian Dividend Stocks

Another feather in the cap of Canadian dividend stocks is the tax advantages they offer. The Canadian government recognizes the importance of dividends as a driver of economic growth and rewards investors with certain tax breaks. Eligible Dividends from Canadian corporations are generally taxed at a lower rate than other forms of income, such as interest or employment earnings when held in a taxable investment account. This means you get to keep more of that hard-earned money in your pocket!

One thing to bear in mind is if you hold Canadian Eligible Dividend stocks in your RRSP, you will lose the tax benefit as funds withdrawn from an RRSP or RRIF are taxed as regular income at applicable income tax rates.

Made with Visme

How to Choose the Right Canadian Dividend Stocks

Now that you’re itching to jump on the Canadian dividend stock train, let me give you a few tips on how to choose the right ones for your portfolio:

Research, Research, Research

Take the time to research different companies and sectors in Canada. Look for companies that have a history of consistently paying dividends, even during challenging economic times. Diversify your investments across various industries to reduce risk. Remember, knowledge is power, and the more you know, the better equipped you’ll be to make informed investment decisions.

Dividend Yield

Pay attention to the dividend yield of a stock. The dividend yield is the percentage of the stock’s price that the dividend payout represents. Generally, a higher dividend yield is more attractive, but be cautious of extremely high yields, as they may indicate underlying issues with the company.

Dividend Growth

Consider the track record of dividend growth for the company you’re interested in. Look for companies that consistently increase their dividend payments over time. This not only indicates financial stability but also ensures that your income from those stocks keeps up with inflation.

Strong Financials

Don’t forget to evaluate the financial health of the company you’re considering. Look at factors like revenue growth, profit margins, and debt levels. A company with a strong balance sheet and sustainable earnings is more likely to continue paying dividends in the long run.

Length of Dividend Payment

Some Canadian dividend stocks are royalty because of the length of their reign! Stocks are considered “aristocrats” after five years of continuous dividend payments and “kings” after fifty years.

Avoid Investing In Things You Don’t Understand

There are some investments that appear to offer very high dividend or distribution yields. For example, split corps or leverage covered call option ETFs. If you don’t understand the underlying mechanics of how these investments work, don’t invest in them. You may be second in the queue to get your capital back when a split corp winds down, or sacrificing upside capital appreciation with covered calls.

What Are The Downsides of Canadian Dividend Stocks?

Of course, there’s no such thing as a free lunch. There can be some downsides and “gotchas” of investing in Canadian dividend stocks.

Reduced Share Price Growth

Canadian companies that pay dividends often do so because they have grown large. Large companies often do not have much growth potential and that becomes reflected in the growth of their share price over time. Yes, you get an income, but you get that at the expense of capital appreciation.

Potential Dividend Cuts

Sometimes, things don’t go well for companies. You need free cash flow to pay dividends to shareholders. If you don’t have the cash, you need to borrow it, which becomes a downward spiral. If you cut the dividend, often the share price tanks too as people rush to cash out and look for better investment options.

How To Get Started With Canadian Dividend Stocks

What Are Some Popular Canadian Dividend Stocks?

One of the most stable and popular sectors for Canadian dividends is the big Canadian banks such as TD, BMO, RBC and Scotia. These banks all have a dividend history extending back well over a hundred years!

Another popular sector for dividends is utility companies such as Enbridge, Fortis, or Canadian Utilities.

Both of these sectors have historically provided solid dividend growth — but do your research before investing in an individual stock!

I Don’t Know What Canadian Dividend Stocks To Pick?!

If you’re new to investing or have limited capital to invest, starting with a dividend ETF is a good idea. An ETF, Exchange Traded Fund, is a collection of stocks managed by someone else. You don’t have to pick individual stocks, although there is a management fee that will be deducted from the performance of the ETF, so bear that in mind.

Some examples of dividend ETFs in Canada include:

- iShares TSX 60 Index ETF (XIU.TO)

- iShares Core MSCI Quality Dividend Index ETF (XDIV.TO)

- BMO Canadian Dividend ETF (ZDV.TO)

- Vanguard Canadian High Dividend Yield ETF (VDY.TO)

- Horizons Active Canadian Dividend ETF (HAL.TO)

Be sure to check the expected tax consequences of ETFs if you hold them in a cash or taxable investment account.

Dividend Reinvestment (DRIPs)

Dividends will appear as cash payments in your investment account. You can then withdraw them or decide to reinvest the cash.

If you are reinvesting, you may want to consider doing that automatically with a Dividend Reinvestment Program. Your investment broker can set this up for you and if the stock is eligible, dividends automatically buy you shares in the same stock.

For example, if you had a dividend in a stock of $60 and the stock price was $52, you would receive one new share in that stock and $8 in cash (normally DRIPs only work for whole shares, but check with your investment broker to see if they do fractional shares).

The best part of DRIPs though is that the trades to get the extra shares are generally free of any fees versus possibly paying a fee to invest the money from the dividends yourself. They also automate the process requiring no intervention from you — your investment grows automatically!

Investing in Foreign Dividend Stocks

Although this post is about investing in Canadian dividend stocks, you may be wondering about investing in foreign dividend stocks. There are two things to be aware of:

- If your investment broker supports holding foreign stocks in your account, you will be subject to foreign exchange rate calculations on any dividends received

- Depending on the type of account and the tax arrangements with the foreign country, you may be subject to a “withholding” tax on dividend payments.

As an example of the above, if you were to open a TFSA with an investment broker and invest in U.S. stocks, you will find withholding tax be removed from your dividend payments. You will also find, that because it’s a TFSA account, there is no way to recover that withholding tax amount even though Canada has a tax treaty with the U.S.

Final Thoughts

You’ve made it through the exciting world of investing in Canadian dividend stocks. You now understand the benefits these stocks can offer: a steady income, a hedge against market volatility, long-term growth potential, and potential tax advantages. Remember to do your research, diversify your portfolio, and ensure the companies you invest in have strong financials.

Of course, it’s important to note that investing in stocks involves risks, and past performance is not indicative of future results. It’s always a good idea to consult with a financial advisor who understands your individual goals and risk tolerance before making any investment decisions.

By investing in Canadian dividend stocks, you’re not only putting your money to work, but you’re also joining a community of investors who have found a path to financial success. So go forth, my friends, and may your dividends rain down like a gentle summer shower.

Disclaimer: This blog post is for informational purposes only and should not be considered financial or investment advice. Please consult with a professional investment or tax advisor before making decisions of your own. The author may hold some of the securities mentioned in this article.