It’s never too early or late to think about retirement planning. But with rampant recent inflation, the lingering effects of a pandemic, and many families struggling to keep their heads above water financially, what does Canadian retirement planning look like in 2023?

Where Do Things Stand?

When Are Canadians Retiring?

According to Statistics Canada, the age at which the average Canadian retires at has increased in the past few years. In other words, recent pressures have delayed retirement for Canadians. The median retirement age depends on what course your career took. Those who worked in the public sector are retiring sooner with a median age of 61.8-years, followed by those in the private sector at 64.9-year, and then those who are self-employed working until 67.8-years old when looking at median averages.

How Much Do Canadians Have Saved?

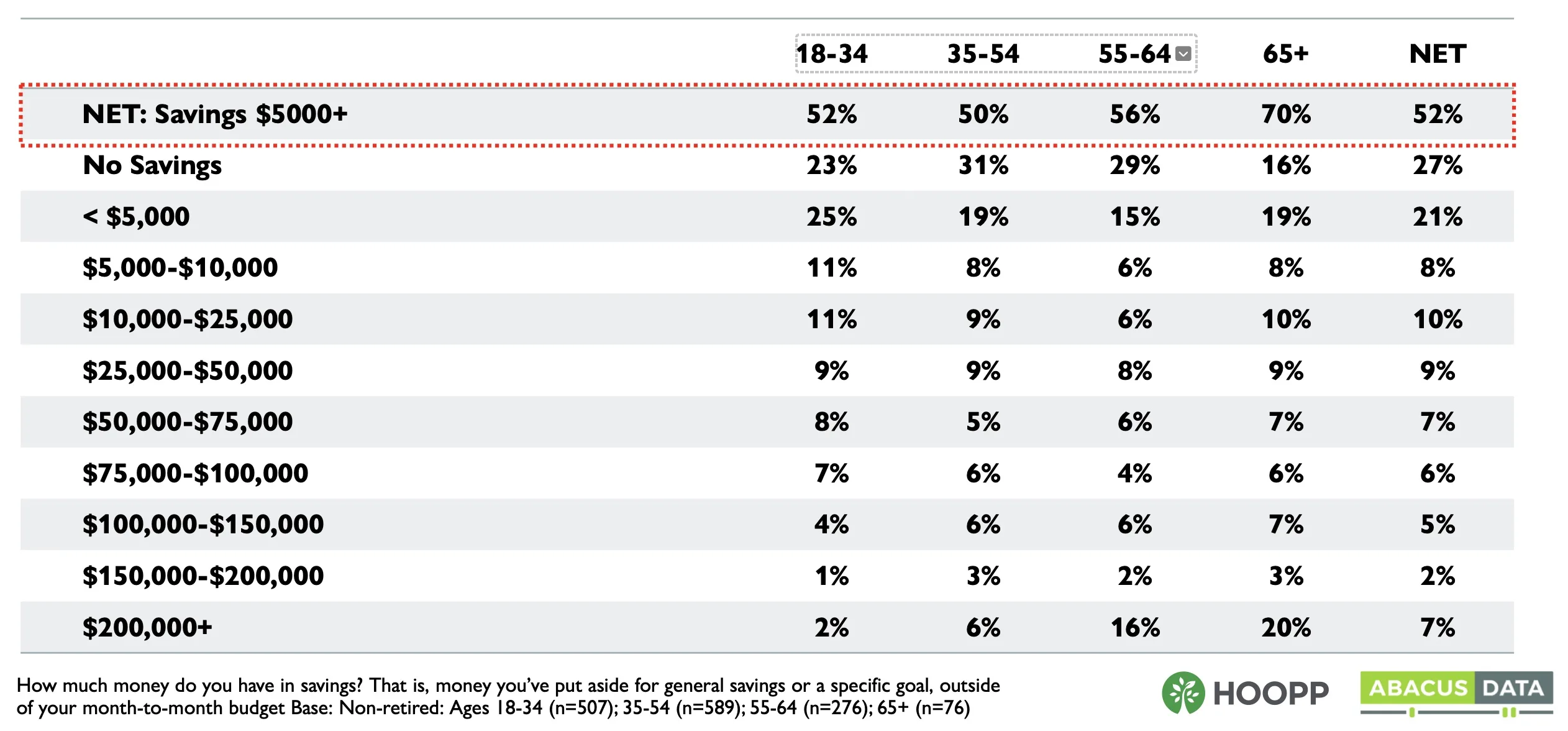

According to the latest Abacus survey conducted for HOOPP, 37% of 18 to 34-year olds surveyed have not set aside any money for retirement yet. The figure is better for those who are 54 to 65, with 78% of them having set at least something aside.

HOOPP/Abacus research data on Canadian savings habits

One striking thing from the above table is 44% of Canadians between 55 and 64-years old have less than $5,000 saved.

Canadian Retirement Planning Is Changing

Due to economic pressures, many Canadians are retiring later, or working part-time into retirement. We’re also living longer than ever.

Once-upon-a-time many people used their home as a retirement savings vehicle (which I am strongly against, personally) and would try downsize on retirement to unlock equity they could then use. With house prices being at record highs all across Canada, moving to the suburbs does not yield the equity pull it once did. Moving further afield puts you away from family and friends, and many of the places that had a significant differential in price are now not much cheaper than the more expensive areas (look at what happened to the East Coast of Canada as an example).

Even old school rules, such as the “60/40” rule and the “4% withdrawal rule”, are being thrown out of the window with how poorly fixed income has performed in recent years, and people living more than 20-years in retirement (which was the basis for the 4% rule).

Your Plan for Retirement

How Much Do I Need?

You may hear financial advisors preach that you need “70-80% of your pre-retirement income” in retirement. But that one-size-fits-all rule is problematic. The real answer is “it depends”.

A recent BMO survey found that Canadians in 2023 estimated they would need $1.7m to retire conformably. This was a considerable jump over 2020 figures of $1.4m, or about a 20% jump.

The good news is that many Canadians retire on far, far less than that every year. A great approach is to build a budget of what you spend today and then adjust as-needed: remove items that you might not incur during retirement (such as a mortgage payment if you will have paid that off, children’s education expenses, etc.), and add in any additional expenses you might incur in your golden years (such as travel, or increased health spending because you might not have employer health coverage anymore).

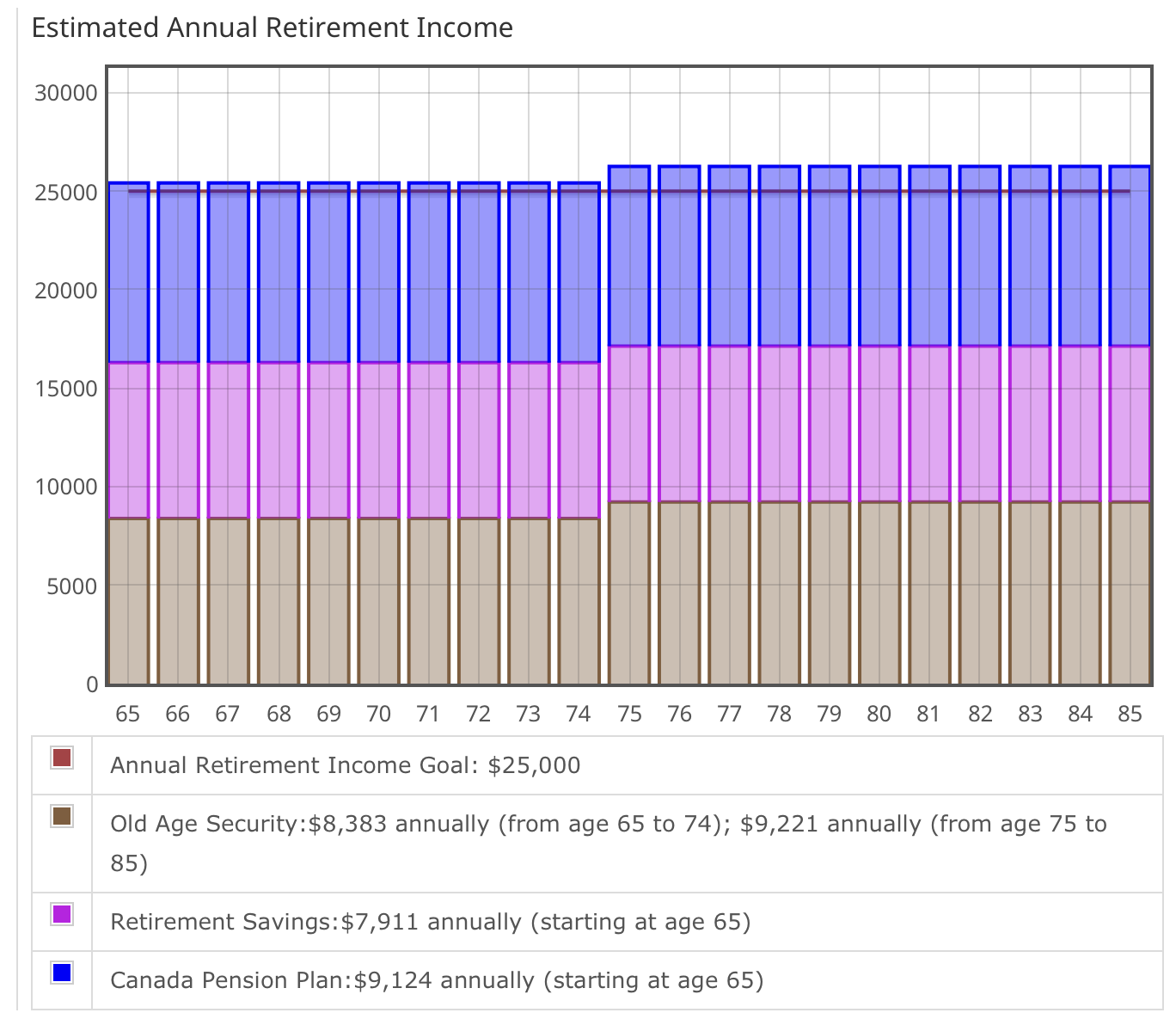

Stack Your Sources of Income

If you have worked in Canada you will likely be getting some level of Canada Pension Plan pension benefit when you retire. While the maximum payment in 2023 for those retiring now is just over $1300, the average amount is a more modest $760.07. If you create a My Service Canada account, you can login and check your estimated CPP pension benefit, and how that would change if you took it at age 60, 65 or waited until 70. Save those figures for a little later as we will put them to good use.

Canada Pension Plan is about halfway through a series of enhancements. The original program was meant to replace about 25% of the average income on retirement — you made up the remainder with OAS and private investments such as RRSPs. The enhanced benefit aims to replace roughly 33% of the average Canadian income pre-retirement, which is a significant boost. The first boost to benefit payments came in during 2019 and this year, whilst the remainder will be phased in starting 2024 through 2025. Of course, CPP contributions have also been raised to accommodate this.

Even if you have never worked, if you have lived in Canada for 40-years beyond the age of 18, you will likely qualify for Old Age Security. In 2023, the maximum is $696.60 between the ages of 65 to 74 and then it rises to $768.46 after that. If you have a fairly high income in retirement, the government will claw this back starting at an income of $86,912 per taxpayer. You can find out more about the clawback here.

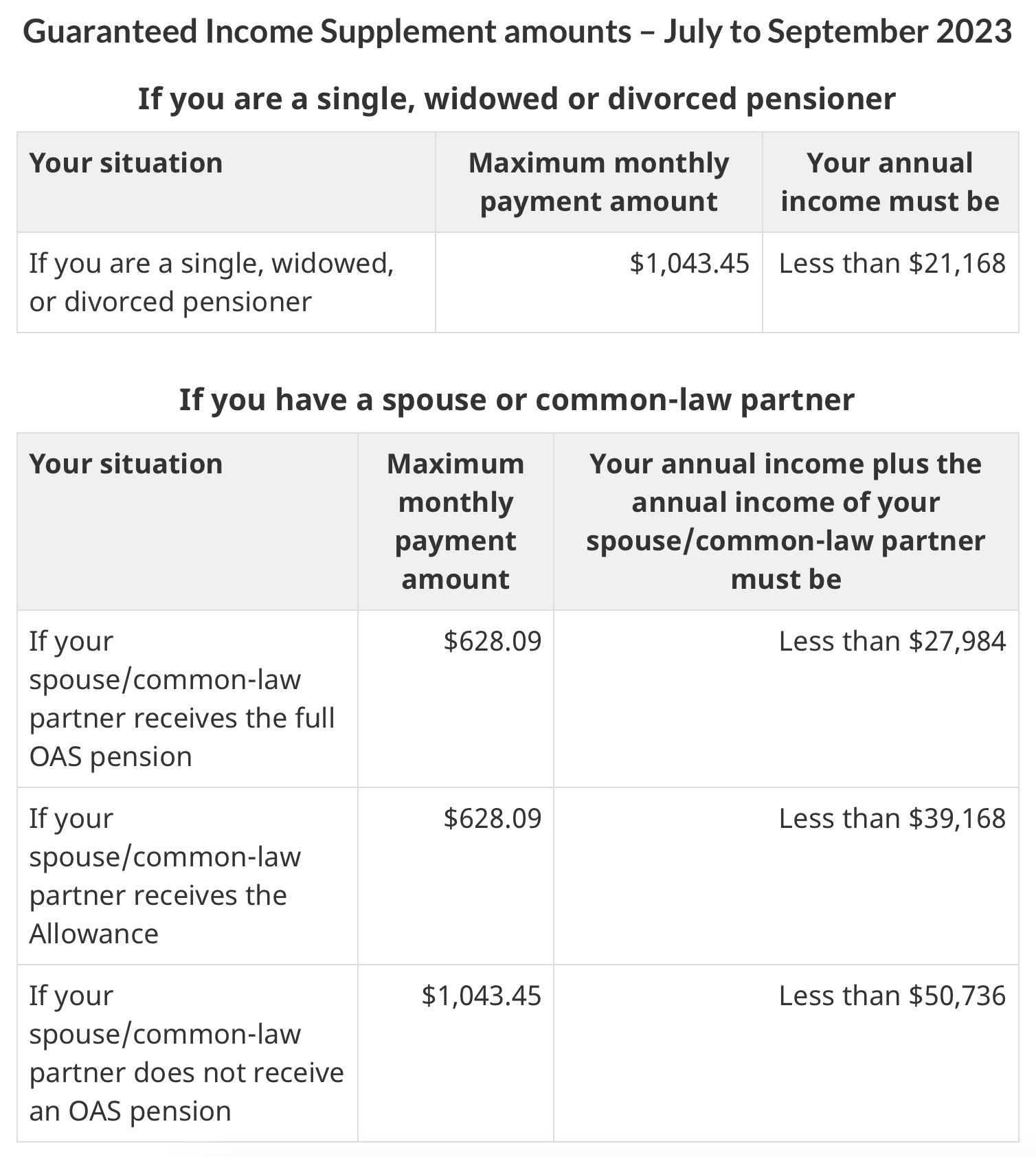

If you are purely relying on your CPP pension and OAS in retirement, you may also be entitled to the Guaranteed Income Supplement. To qualify for the GIS, your income must be below $21,168 if you’re single, widowed, or divorced. If you have a spouse or common-law partner, your combined income has to be below $27,984 if your partner receives the full OAS pension. The following table details the scenarios:

If you have an employer pension scheme, either defined contribution or defined benefit, ask your pension plan administrator for your expected pension income in today’s dollars. This would be the figure not taking into account future inflation. Now would also be a good time to find out if your pension payments are indexed to inflation — if not, they’ll effectively get smaller and smaller during your retirement years, which will be something you’ll have to account for.

One of my favourite retirement calculators actually comes from our own government. Using the figures you got for your CPP pension benefit from My Service Canada, OAS (if you qualify), your employer pension (if applicable), and any savings you expect to have, you can start to estimate your income in retirement. You can then add in GIS if you’re under the income threshold and get a glimpse in today’s dollars of what retirement might look like. It will even estimate your life expectancy as part of the calculator.

How To Get Started

Optimize Your Spending

Many people do not start saving for retirement because they simply cannot afford it over and above their day-to-day spending needs. This is understandable le.

Our recent blog article on saving money on food costs is a great way to squeeze a little more budget to allocate for retirement saving.

Other areas you can look for a little free cashflow are recurring expenses such as phone plans and streaming services. Even eeking out $100/month in savings and investing that in your retirement makes a difference if you start early!

Decide on TFSA and RRSPs for Canadian Retirement Planning

RRSPs have traditionally been heralded as the preferred retirement savings vehicle. But TFSAs will outperform RRSPs in some scenarios, especially if you’re a lower income earner. A quick rule of thumb is if you currently make $50k or less, then a TFSA might be better. The other advantage of a TFSA is the income is completely tax-free in retirement — RRSP (or technically RRIF) income is taxable income in retirement.

Check With Your Employer

Some employers will match (or even more than match) RRSP contributions. This is essentially free money and maximizing this benefit just makes good financial sense. And because of the power of compounding, that free money creates more free more over time.

Start Saving

You could keep your retirement savings under your mattress, but we don’t recommend it. Investing in the stock market generally outperforms even High Interest Savings Accounts.

If you’re overwhelmed by the thought of picking the right stocks, we recommend starting with index ETFs (Exchange Traded Funds). Canadian Couch Potato’s methods are a good start and you can read about it all here.

Stay Invested and Start Early

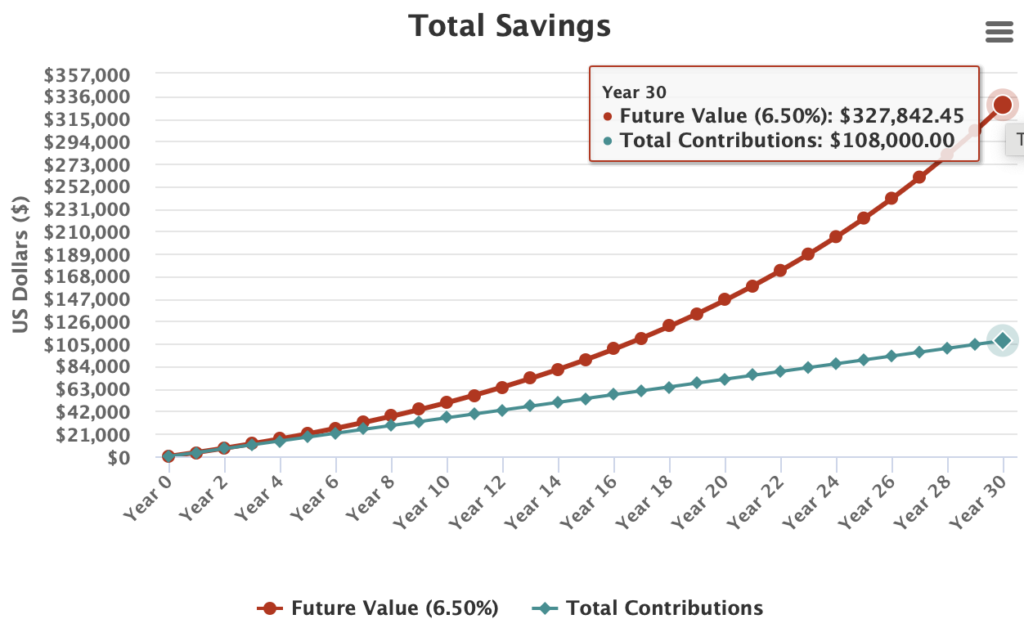

The amount of time you stay invested plays a significant role in how your retirement savings will shape up.

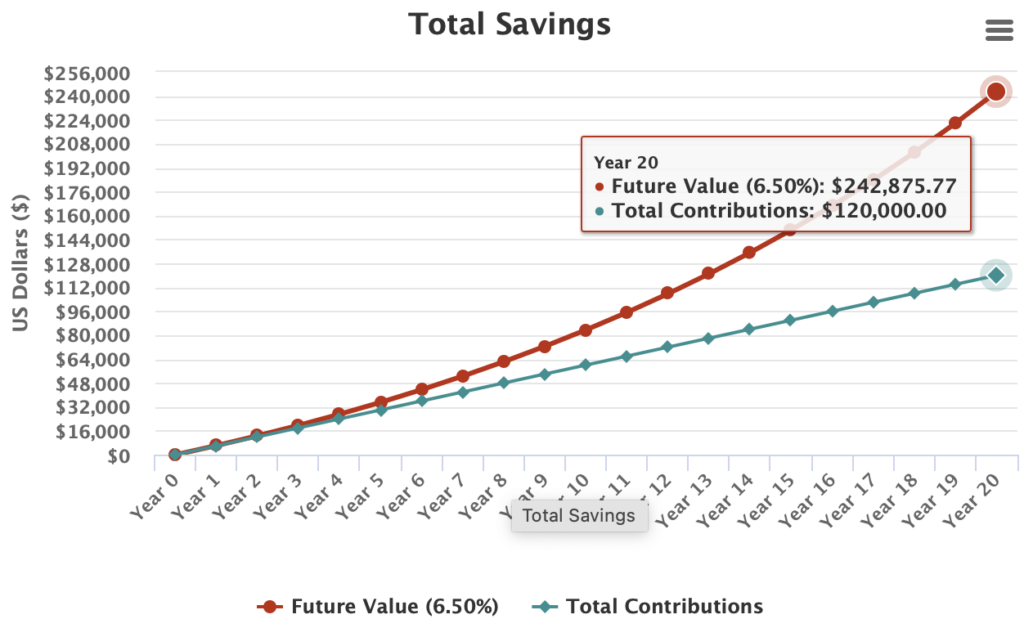

The chart below is an example of a 35-year old who manages to save $300/month for the next 30-years. In the early years, the total of their savings isn’t much more than what they’ve put in (blue line). The red line shows how their savings grow, and you can see that actually accelerates over time. With $108,000 contributed to their savings, the end result is a balance of over $327,000.

Imagine you’re a bit later to the game. You wait until you’re 45-years old, but are more motivated and contribute $500/month to your retirement savings. When you retire at 65, you’ve contributed an additional $12,000 versus the first scenario. But, more importantly, you actually end up with around $85,000 less.

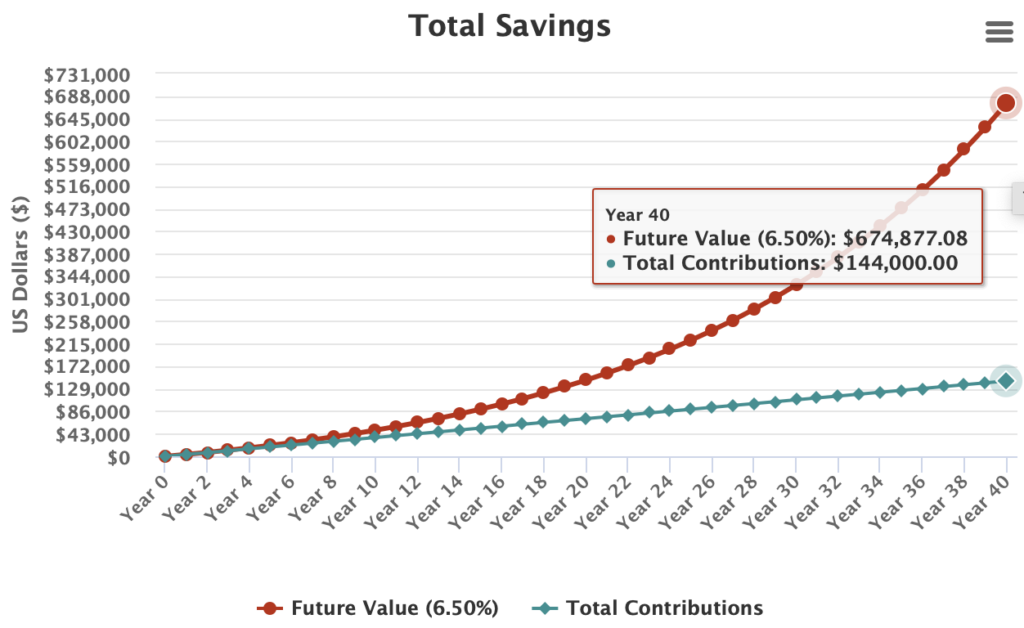

You may notice we use a 6.5% rate of return. The Toronto Stock Exchange (TSX) has returned an average of 9.3% per year from 1960 to present. But using that figure is problematic: it doesn’t take in to account inflation, many expect returns in the near future to be more conservative, and you may have some fixed income investments as well which generally provide a smaller return. So, we’ve blended things and used a more realistic 6.5% for our calculations.

What would happen if you were a real go-getter and started saving $300/month roughly when you got your first real job at 25-years old and still retired at 65?

Starting at 25-years old doesn’t dramatically increase your contributions (remember: it’s spread over 40-years), but it does dramatically increase what you end up with. Your nest egg is now nearly $675,000. Slow and steady wins the race here.

Put Things on Autopilot

If you never have the money sitting in your account in the first place, it’s hard to miss — right? Setting up an automatic transfer from your chequing account to your savings or brokerage account is a good idea. Some brokerages even allow automatic transfers to trigger recurring stock or ETF purchases, which is another way to “set it and forget it”.

Don’t Forget About Inflation

It’s deceptive to look at the graphs about and think “wow, I’ll have X dollars in retirement”. You have to remember that inflation erodes the spending power of your money over time just like compound interest grows it.

Make a Date With Yourself to Re-visit Your Canadian Retirement Planning Annually

Retirement planning isn’t a “set it and forget it” task. Make an appointment with yourself (and a professional, if necessary) annually to see where you stand. Markets change, goals change, life happens.

Don’t Be the Richest Person in the Graveyard

Remember, having a good retirement should not come at the cost of not living life today. It’s all about balance.

Canadian Retirement Planning Action Items

- Start as soon as possible, even if it’s with a relatively small sum. You can always increase the amount as you get older and have more financial ability.

- Pick investments with longevity. Focus on quality companies with a proven track record.

- Use index ETFs or broad sector (such as banking) ETFs if you’re feeling overwhelmed. Review and rebalance regularly.

- Stay invested, which includes keeping honest about making regular contributions.

- Don’t be afraid to get professional advice to estimate what you might end up with in retirement. We recommend no-fee financial advisors.

- Include all yours sources of income in your “stack”: private savings, CPP, OAS, GIS, rental income, annuities.

- Optimize your strategy from day one: TFSAs for low-income individuals, RRSPs for higher income.