Inflation is a term that often makes headlines and creeps into our daily conversations about the economy and money. It’s a concept that impacts our purchasing power, investments, and overall financial well-being. But what exactly is inflation, and why is it so important to understand? In this blog post, we’ll demystify inflation, explore its causes and effects, and discuss strategies for managing it. By the end, you should understand more about inflation in Canada!.

What Is Inflation?

Inflation is the sustained increase in the general price level of goods and services in an economy over a period of time. Put simply, it means that as time goes on, the cost of living tends to rise. When inflation occurs, each unit of currency buys fewer goods and services than it did before. For example, if the inflation rate is 3% annually, a $100 purchase this year would cost $103 next year.

What is the Consumer Price Index?

When the term inflation is used, the actual measure behind it is generally something called the Consumer Price Index. In Canada, Statistics Canada tracks this. The Consumer Price Index is a basket of common household expenses that includes shelter, household goods, transportation costs, and other items necessary for daily life.

Made with Visme

The original calculations for the Consumer Price Index set a value of 100 for this basket of goods and services. The reported values are always the difference between prices when that basket was set and now.

Because prices are not the same all across Canada and there may be local variations, Statistics Canada samples prices in multiple territories and provinces to create a better representation of Canadian prices.

Additionally, from time to time the proportions of each constituent of the basket are rebalanced. For example, if shelter becomes more expensive for the average Canadian, it will then have a larger proportion of the overall basket.

How Much Is Inflation in Canada?

Inflation (or deflation) is a measurement between two specific points in time. Because of that, you’ll often see headlines such as “year-over-year inflation hits 8%”. This would mean that versus the same time last year, inflation has risen by 8%. You may also come across month-to-month inflation figures such as “March inflation was 3.2%”. This doesn’t mean that prices went up 3.2% in March! It means that if you were to extrapolate March’s inflation rate into an annual rate, it would be 3.2% on an annualized basis.

A small amount of inflation is generally seen as good for an economy. The Bank of Canada’s target inflation rate is set at 2%, but they consider the range of 1% to 3% to be acceptable.

At the time of writing, the year-over-year inflation rate in Canada is 3.3%. This is sometimes referred to as “headline inflation” as it’s the most often reported interpretation of inflation.

Inflation in Canada Has a Target

Many people are surprised that the Canadian government, and therefore the Bank of Canada, has a target set for the amount of inflation they would like to see in the economy. Many people assume that the target would be no inflation, but it’s not. In 1991 Canada’s monetary policy changed and a 2% inflation target was established.

Most economists agree that a moderate amount of inflation is actually a stimulant for the economy and production. The key word here is moderate. Cynics have argued in the past that government policy is more of a manipulation tactic. For example, the 2% inflation target for Canada came into existence when unions were demanding wage increases — and the government used this as a bargaining chip.

However, for consumers and businesses alike, knowing that inflation is targetted to be around 2% does indeed make life more predictable. Businesses can account for wage and production cost increases. Those retiring 40 years from now can estimate what their retirement earnings will be worth in today’s dollars (purchasing parity). 2% is a magic number as well because it’s deemed to be around when the economy is running at “maximum capacity.

How Does Canada Manage Inflation?

The Bank of Canada maintains something called the “overnight rate”. You can think of this like the accelerator and brakes on a car. When the Bank of Canada wants to accelerate the economy, they lower the overnight rate and money is cheaper for banks to borrow. In times of high inflation, the bank can also press the brake by raising the overnight rate. Raising the rate increases borrowing costs for banks, which in turn pass those increased costs on to consumers by raising interest rates on debt.

The way in which most consumers feel changes in the overnight rate is through mortgages. Those with variable-rate mortgages will feel changes more quickly when their mortgage payments change in line with the overnight rate. Those with fixed-rate mortgages will find that renewing their mortgage may be cheaper or more expensive than the current payment depending on how the overnight rate has changed.

Causes of Inflation in Canada

Demand-Pull Inflation

This type of inflation occurs when the demand for goods and services exceeds their supply. When demand outstrips supply, businesses can raise their prices, leading to inflation.

We saw demand-pull inflation on things like recreational vehicles during the pandemic as everyone rushed to buy them.

Cost-Push Inflation

This occurs when the cost of production for goods and services rises, causing businesses to increase their prices to maintain their profit margins. Factors such as rising wages, increased raw material costs, or supply chain disruptions can contribute to cost-push inflation.

This became evident during the pandemic in the spike in grocery costs.

Built-In Inflation (Wage-Price Spiral)

This type of inflation occurs when workers demand higher wages to keep up with the rising cost of living, and businesses pass those increased labour costs onto consumers in the form of higher prices. This cycle can perpetuate inflationary pressures.

This is a current challenge for Canadian economic policy as many employers have had to dramatically raise employee’s wages/salaries so they can cope with inflation.

Monetary Policy

Central banks, like the Federal Reserve in the United States, can influence inflation by adjusting interest rates and money supply. Lowering interest rates or increasing the money supply can stimulate spending and economic growth, but if done excessively, it can lead to inflation.

Effects of Inflation in Canada

Understanding inflation is crucial because it has far-reaching effects on various aspects of the economy and our personal finances:

Purchasing Power

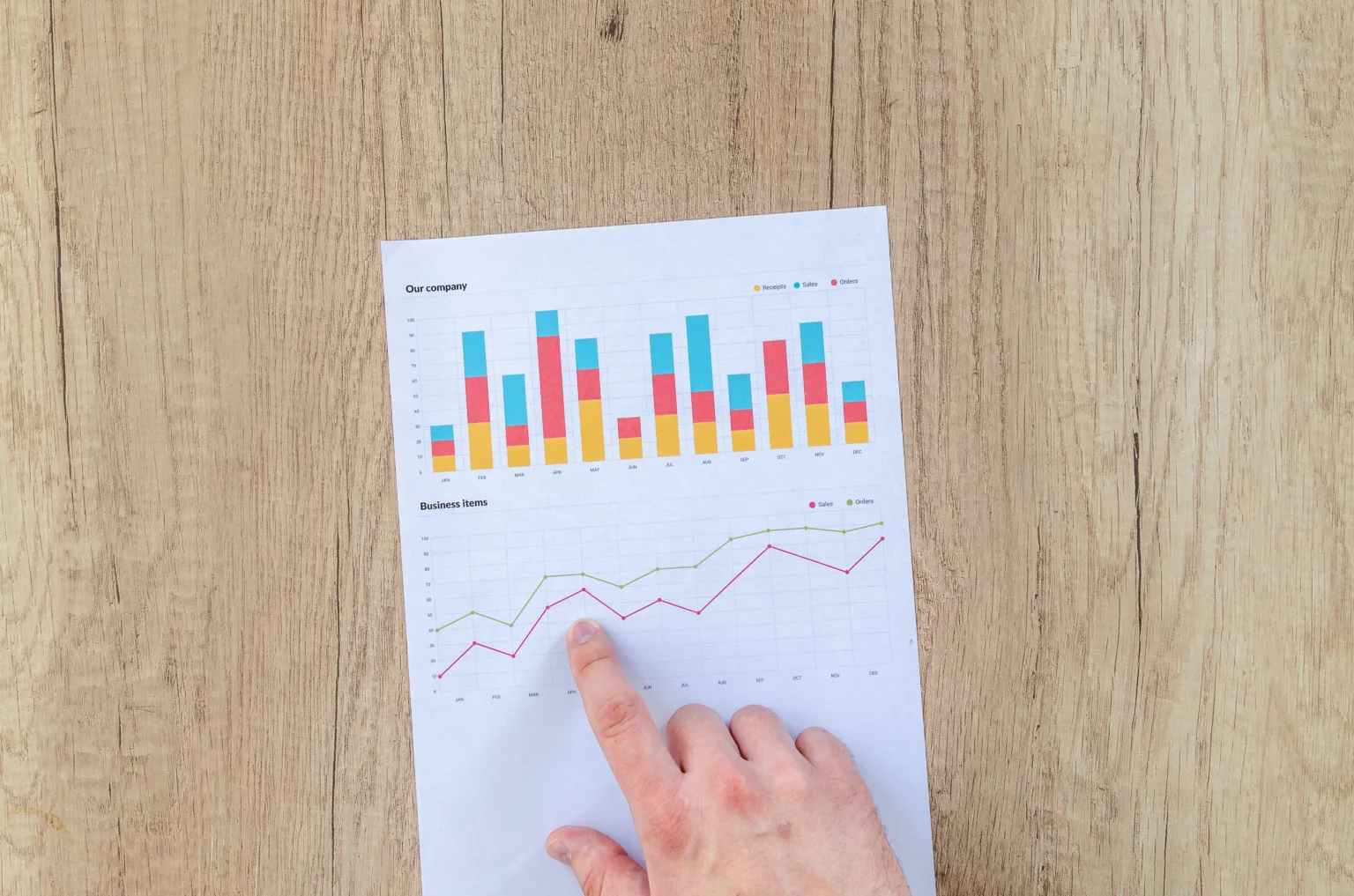

Inflation erodes the purchasing power of money. As prices rise, your money can buy fewer goods and services, which affects your standard of living. The following chart illustrates how 2.5% inflation decimates your purchasing power.

Made with Visme

If we were to use real-world figures for Canada, we’d see that between July 2018 and July 2023 your overall purchasing power has dropped 17.72% per Canada’s CPI figures. You can do your own calculations with the Bank of Canada’s calculator.

Savings and Investments

Inflation can erode the real value of your savings and investments. If the rate of return on your investments doesn’t outpace inflation, your wealth will decrease in real terms.

Using the previous example where inflation between July 2018 and July 2023 was nearly 18%: if you have not made 18%+ return on an investment in that time, you have effectively lost money. Of course, there might be an opportunity for the investment to still catch up on that loss if you don’t sell it.

Interest Rates

Central banks may raise interest rates to combat high inflation. This can make borrowing more expensive and savings more attractive but may also slow down economic growth.

Uncertainty

High or unpredictable inflation can create uncertainty in the economy, making it difficult for businesses to plan and invest for the future. Lack of investment leads to further economic woes.

Where Is Inflation in Canada Headed?

The Bank of Canada releases monthly Monetary Policy reports. The July 2023 report states that:

“Inflation in Canada and around the world has been coming down. The Bank projects that inflation will stay around 3% for the next year, returning to the 2% target by the middle of 2025.”

Bank of Canada, July 2023

Managing Inflation

While individuals can’t control inflation, they can take steps to mitigate its impact:

Invest Wisely

Diversify your investments to include assets that historically perform well during inflationary periods, such as stocks, real estate, and commodities.

If you are keeping your savings in cash, make sure you choose a savings account that currently beats the headline inflation rate.

Budget and Save

Create a budget to manage your expenses and prioritize saving. For example, use our money-saving tips for groceries as groceries are a major household expense.

Reduce your debt as much as possible as interest rates are often high during periods of inflation.

Protect Your Income

Negotiate for higher wages as often as possible, and invest in skills and education to remain competitive in the job market. If you are part of collective bargaining in a union, only vote for wage increases that exceed inflation.

Wrapping Up Inflation in Canada

Inflation is a fundamental economic concept that affects all of us in various ways. By understanding its causes, effects, and potential strategies for managing it, individuals can make informed financial decisions and navigate the ever-changing economic landscape more effectively. Staying informed about inflation and its trends can help you protect your financial well-being and make prudent choices for the future.

Thanks for this comprehensive article on inflation.

Inflation risk is something that everyone must be address before retirement. I cannot emphasise enough the importance of investing to mitigate the depreciative effects it has on one’s wealth.

On a day-to-day basis, I definitely think we can budget and shop more wisely (e.g. buy house brand products) to lower our expenses. Credit cards cash back is another money-saving hack, provided that one uses his cards responsibly.

Great article! 😊