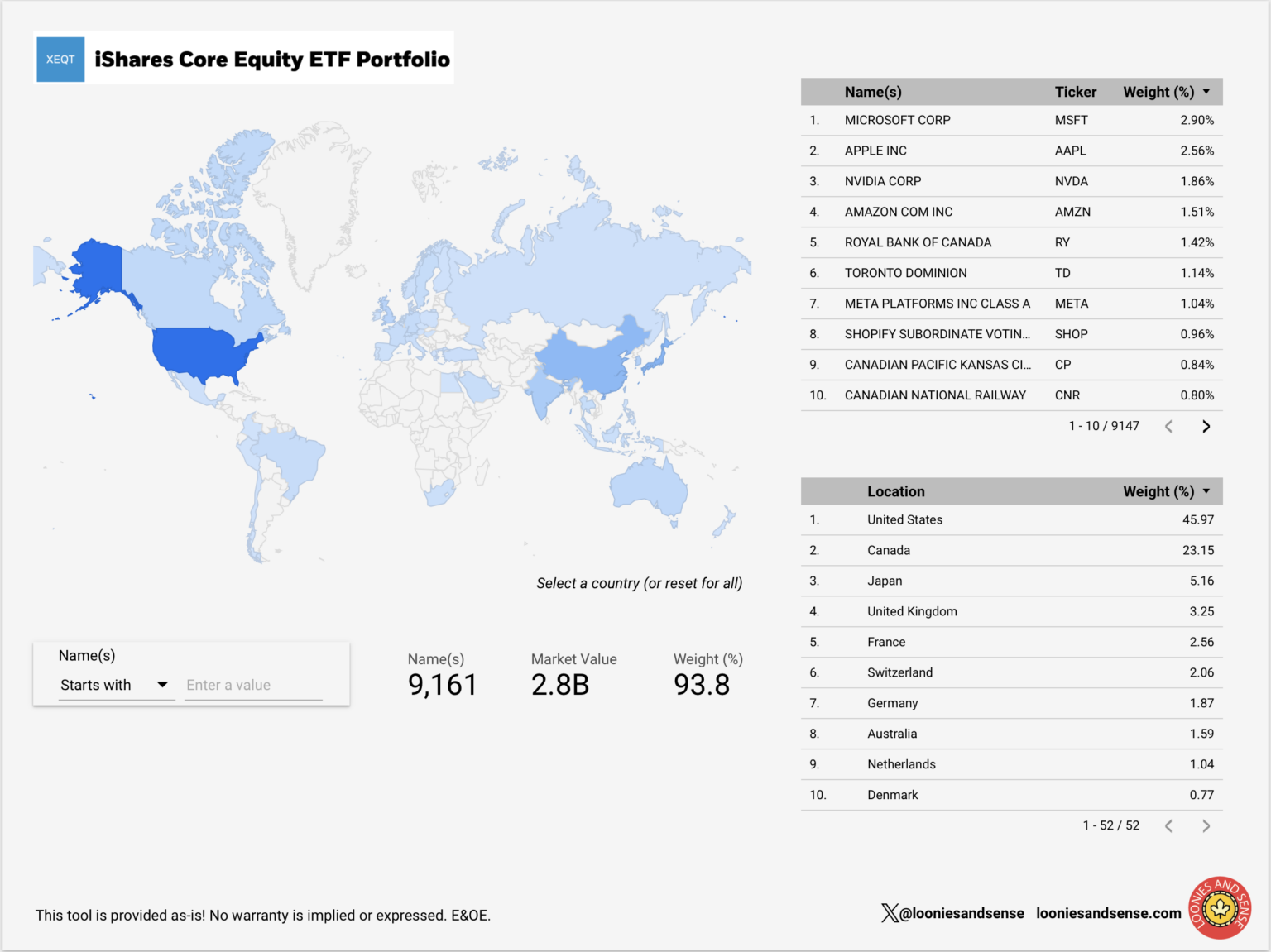

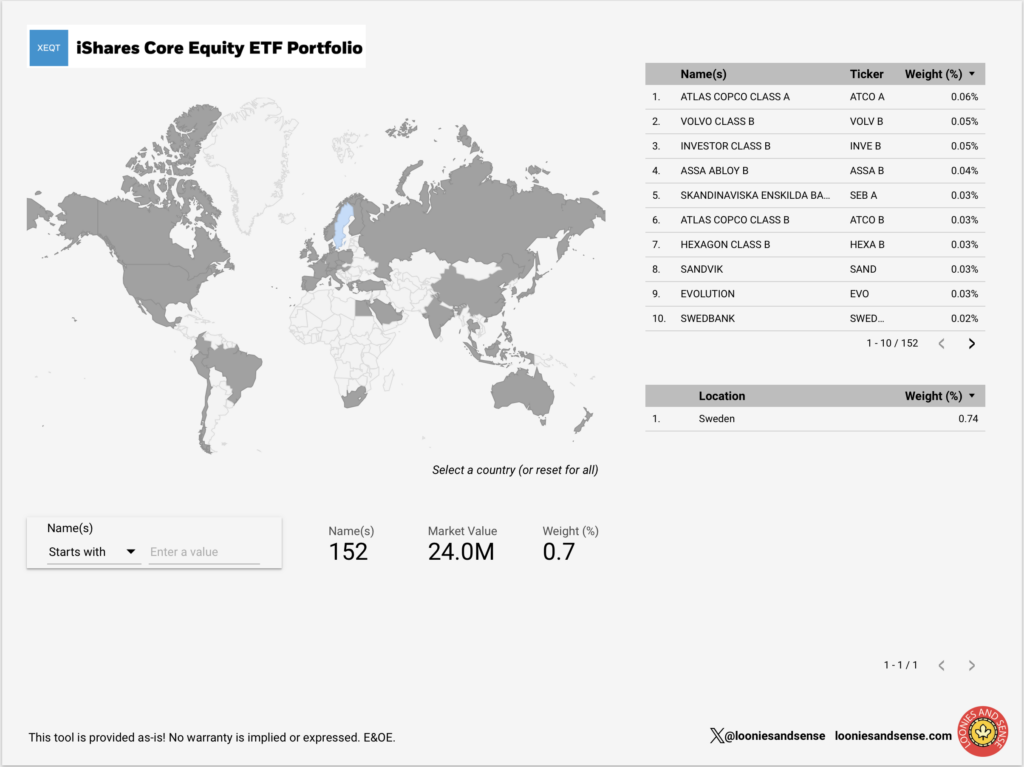

It’s no secret (especially if you follow me on X) that I’m a big fan of funds like BlackRock’s XEQT. Being the market, rather than beating the market, makes a lot of financial and mathematical sense.

But what is Blackrock XEQT invested in? Sure, you can download the raw data yourself from BlackRock’s website, but what if some nice person already did that for you? And made pretty reports?

Enter ETF Explorer

XEQT Explorer is a Google Looker business intelligence app that I put together. You can access it directly from this link. You may need to be logged in to a Google account to use it.

XAW Explorer is also a Google Looker BI app, but instead of using XEQT as a data source, it uses the XAW fund from BlackRock. XAW is very similar to XEQT but has the Canadian investments removed. You can access that version here.

But what can you do with them?

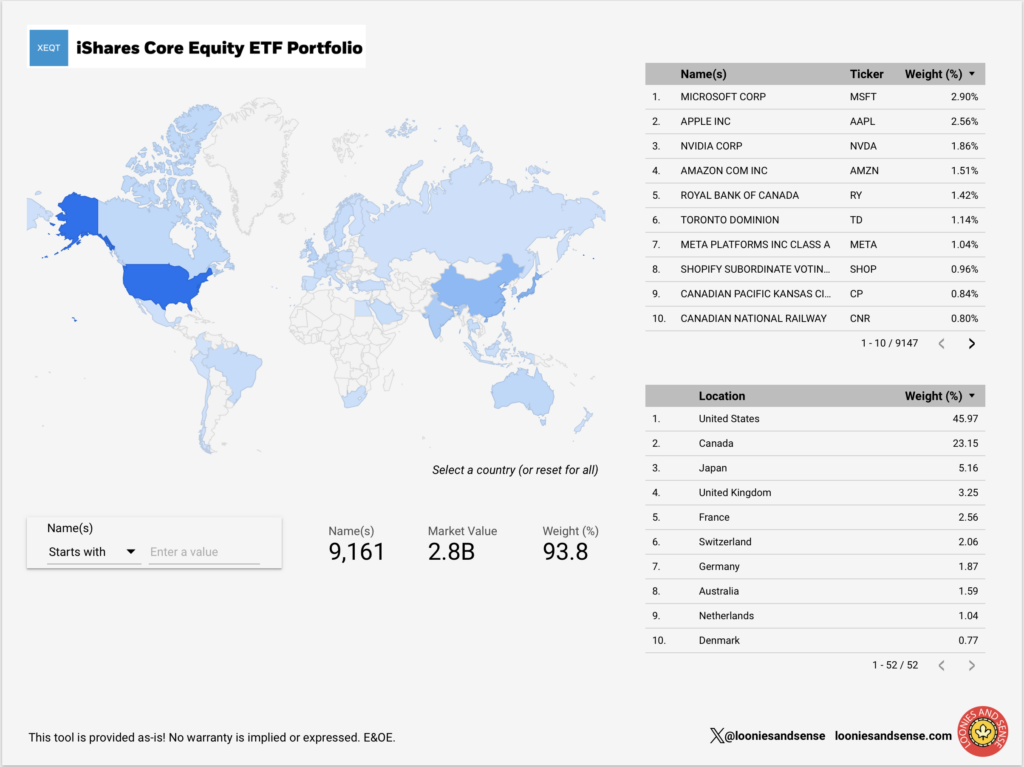

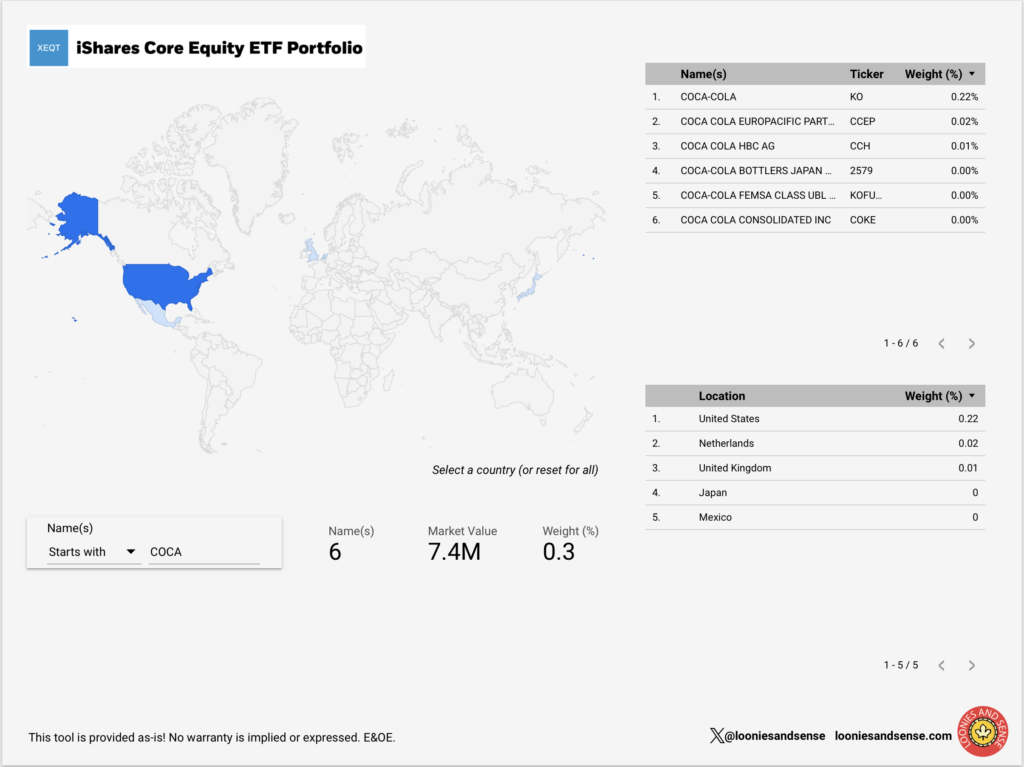

Geographic Exploration

Sector and Exchange Exploration

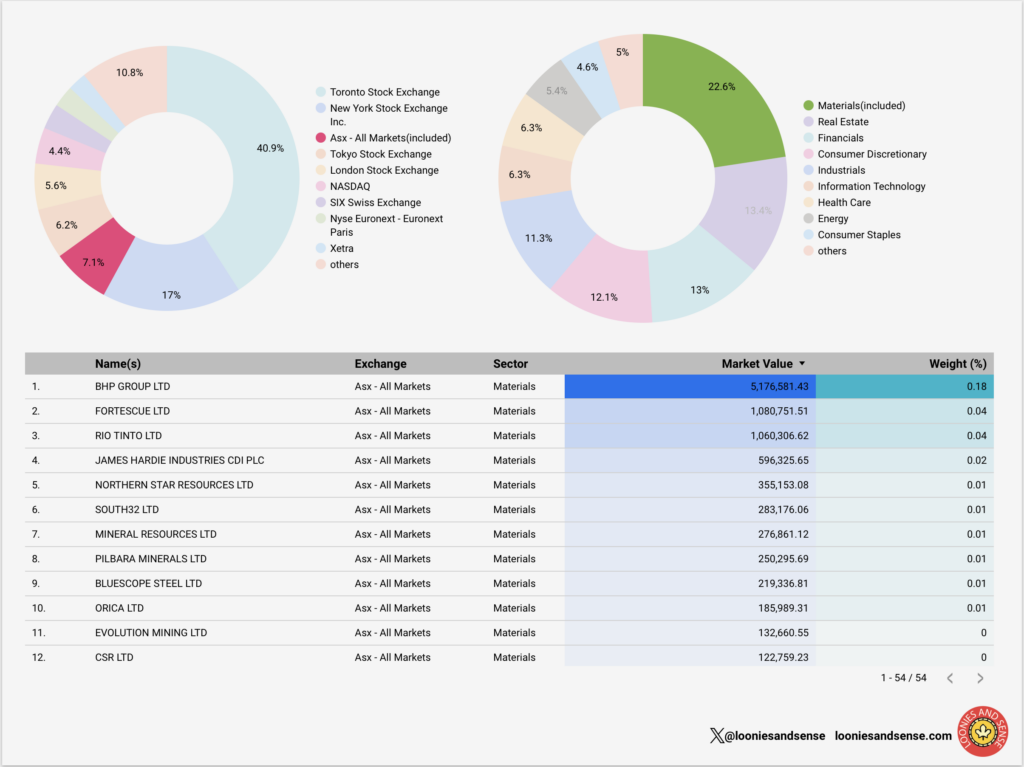

The second page of the Explorer contains a drill down for exchange and sector.

We can do fun things here. Like drill down and see al the materials companies on the Australian Stock Exchange:

Using the Explorer and Known Issues

It’s quite easy to “paint yourself into a corner” with selections. Just click “reset’ and start over.

The Explorer is a little slower than I’d like, but that’s predominantly a function of the data source and I can’t control that.

Automagic updating of the source data isn’t happening just yet. It’s actually proved to be more challenging than expected. I won’t get into the technicalities, but I’m working on that.

You may notice the weights in the fund only add up to ~93%. I’ll ask BlackRock about this, but I suspect it’s a rounding error issue. All weights are truncated to two decimal places in the source data.

I may build a BlackRock XAW version of this as I know the underlying data is similar. I haven’t looked at Vanguard’s VEQT as a data source, but if there’s enough interest I might.

If you want to provide feedback, the best thing to do is to tag me on X. DMs or emails should be a last resort. Your question or comment is likely helpful or interesting to the community!

Enjoy.