The Time of Your Life

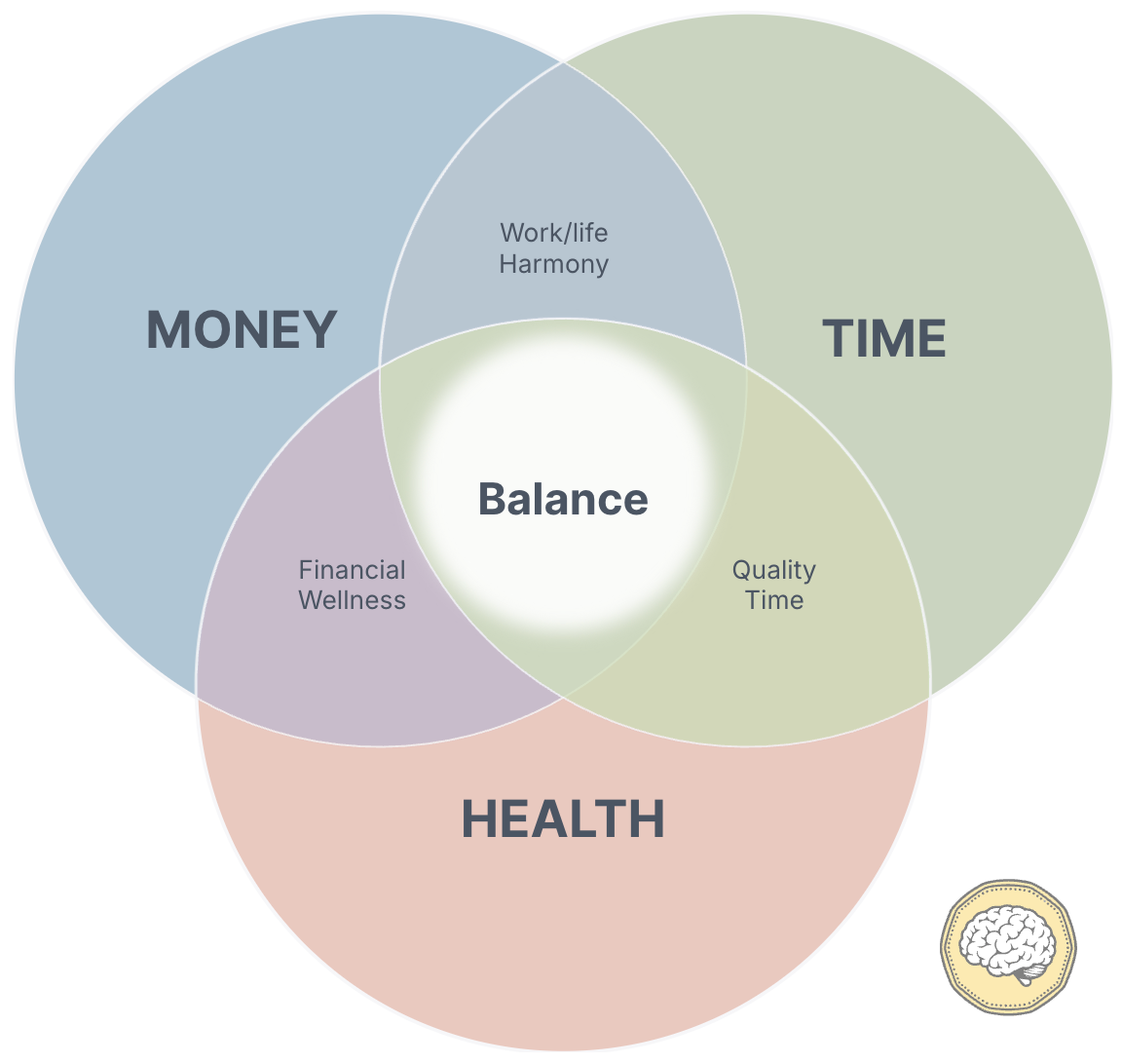

We spend countless hours planning our financial future, obsessing over retirement accounts and investment returns. But there are resources far more precious than money that many of us fail to manage with the same care: our time and health.

The Missing Dimension in Retirement Planning

Traditional financial planning focuses heavily on ensuring you don't run out of money. But what about ensuring you don't run out of quality time? Or that we don't retire into ill health?

These questions led me to create the Time of Your Life App – a tool that turns abstract numbers into a powerful visual representation of your remaining life.

Beyond Life Expectancy: Understanding Your Time Horizon

Life expectancy is just a statistical norm based on large populations. When we talk about having "30 years left," it feels abstract and distant. But what if you could see those years broken down into the activities that will fill them?

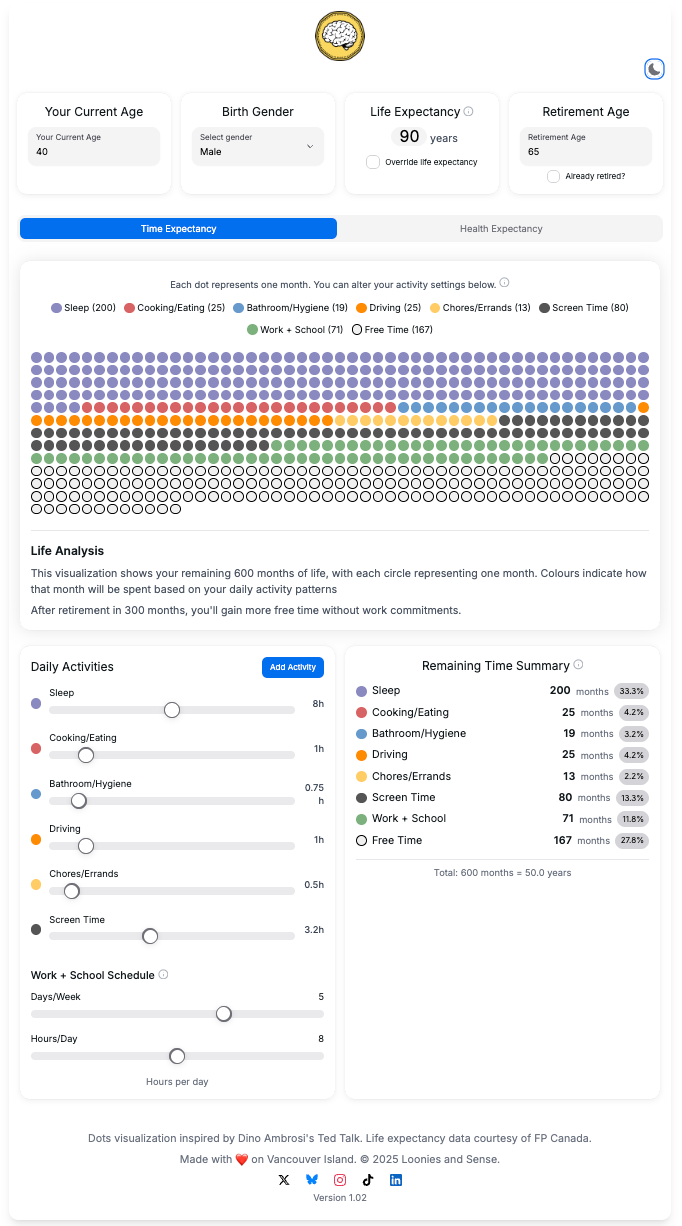

The Time Expectancy visualization uses coloured circles to represent how you'll spend the rest of your life:

- Purple circles represent sleep (about a third of your life for most of us!)

- Green circles show time at work (until retirement)

- Orange circles represent chores and errands

- Blue circles indicate personal care

- Charcoal circles show screen time (the basis of the TedX talk that inspired the data visualization)

And perhaps most importantly, those white circles represent your truly free time – the blank canvas where your dreams, personal fulfillment, and meaningful experiences live.

For many, seeing how few white circles remain is a wake-up call.

You can also add your own activities to the visualization and note the impact on how much free time you will have. Maybe that's going to the gym, or walking the dog every day.

Health Expectancy: Quality Over Quantity

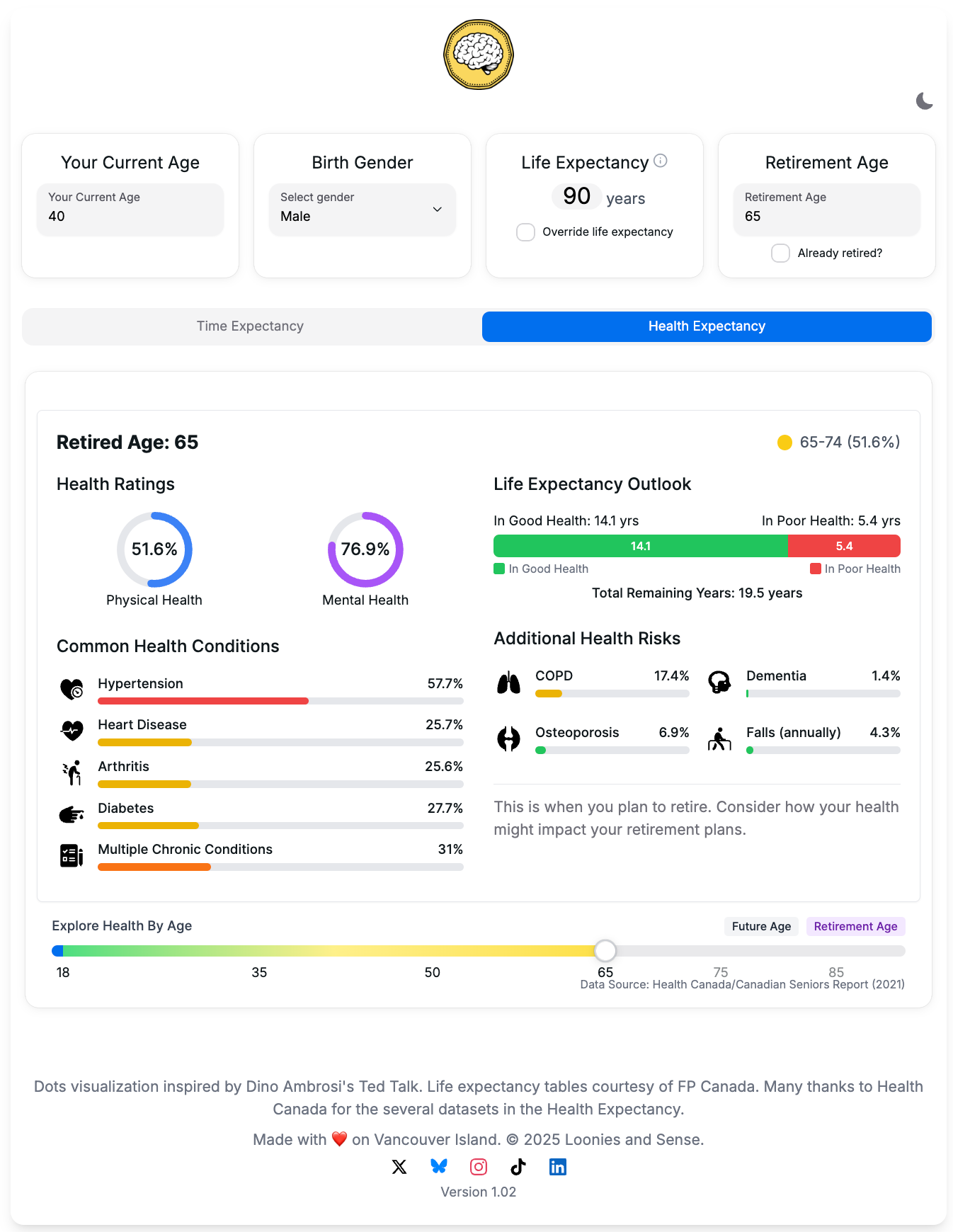

Living longer doesn't necessarily mean living better. The "Health Expectancy" feature of the app integrates data from Health Canada surveys to show not just how long you might live, but in what state of health.

This data reveals something crucial: health outcomes often decline dramatically during traditional retirement years – precisely when many people finally have the "free time" they've been saving for.

Of course, you can improve your odds of healthier retirement years by:

- Reducing stress

- Being mindful of substance use

- Improving sleep quality

- Eating a balanced diet

- Increasing physical activity

But perhaps most importantly, you can redesign your financial life to support your health and wellbeing before retirement age.

A Personal Journey: Why This Matters to Me

This isn't just theory for me — it's my lived experience. At age 45, I found myself at a crossroads. My health had been deteriorating for several years, and my wife asked me to stop working. I can vividly hear her saying: "we don't want to lose you".

That moment forced me to confront the reality of my own remaining circles. Would I spend them pursuing more money at the expense of my health? Or could I redesign my life to prioritize what truly mattered?

I chose the latter path. I stopped full-time work and rebuilt my life and finances around a new model — one that allowed me to recover my health.

That led to today where I work part-time helping others with their personal finance. I draw not just from textbooks but also from the challenging process of remodeling my own life.

Along the way, I got to spend a lot of time with my son – something you cannot go back and get later. We had some adventures. And we eventually found our way to Vancouver Island.

About the Data

The life expectancy estimates are based on FP Canada's 2024 Project Assumption Guidelines. This dataset aims to predict your remaining life expectancy based on current age and birth gender.

The Health Expectancy visualization draws from several Health Canada datasets, with particularly detailed information for ages 65+ from a 2020 report on senior health. In particular, it uses Health Adjusted Life Expectancy (HALE) to give you an idea of not just how many years you might have left: but how many years are spent in good and poor health. This part of the visualization appears at age 65 and above.

You may note that screen time is set to 3.2 hours per day by default. This is from a dataset called "Physical Activity, Sedentary Behaviour and Sleep (PASS) Indicators" assembled by the Public Health Agency of Canada.

Financial Planning As Life Planning

This sobering reality check isn't meant to depress you — it's meant to empower you. Because unlike money, time cannot be earned back once spent, and health is very hard to regain.

What if you could:

- Retire three years earlier? That's more white circles during potentially healthier years.

- Work four days a week instead of five? That adds more white circles and reduces stress, which hopefully leads to better health outcomes later.

- Afford to take a sabbatical when your children are young? You can't turn back the clock.

Financial planning isn't about maximizing account balances. It's about ensuring your money serves your life — not the other way around.

What Will Your Circles Reveal?

Don't leave your most precious resources to chance. Take a few moments to visualize your time and health with the app. I hope it provides clarity that might just change how you approach your finances, career, and daily habits.

Click the banner to access the app or visit life.looniesandsense.com

I'd love to hear your story of whether this tool helped you start to remodel your life. Feel free to reach out via my contact form, or via the social media platforms at the bottom of the app.

A shout out to super-star financial planner Aaron Hector CFP who shared the TedX talk video with me that inspired the data visualization style. And many thanks to Dino Ambrosi for his novel data visualization concept and original TedX talk.

Marc is an advice-only financial planner. He helps DIY investors "fill in the gaps" with retirement planning, taxes, estates, risk mitigation, and more. You can read more about that here. Of course, this isn't financial advice – but if you want financial advice, reach out.