An Ode to XEQT

BlackRock's XEQT is a 100% equities-based ETF that provides global market exposure with an appropriate home country bias, making it a simple, one-stop investment solution for Canadians.

If you follow me on X, you might notice I'm a big fan of global asset allocation ETFs. In particular, BlackRock's XEQT is a 100% equities global asset allocation ETF designed to be an "all-in-one" portfolio for Canadians. It might be the only investment you ever need, as it offers broad global market diversification in a low-cost package tailored explicitly to Canadian investors.

While I'm specifically discussing BlackRock's XEQT in this post, I consider Vanguard's VEQT interchangeable, although there are some minor differences in investment universe, allocations, and rebalancing. You don't need to overthink your choice here; pick the company you're comfortable with!

What Is It?

As the name suggests, "all-in-one" Exchange Traded Funds (ETFs) are designed to be the only investment you need. This is psychologically hard for many investors who enjoy the thrill of 'trading’ stocks and chasing quick wins. But they do work best when they're the majority of your portfolio.

ETFs can be purchased just like stocks during the hours the Toronto Stock Exchange is open and are priced continuously during the day. Someone always makes a market in an ETF, so liquidity is generally reasonable. This market-making also helps keep the ETF close to its NAV (Net Asset Value) – you're not usually paying much of a premium over the underlying value of the assets.

BlackRock's XEQT has about CAD$4.8bn of assets at the time of writing. Since its launch in 2019, it's become a very popular ETF for Canadians who want broad market exposure.

XEQT invests purely in equities, but other asset allocation funds from BlackRock and Vanguard offer a pre-defined fixed-income allocation if you prefer.

As a side note, XEQT is not technically an index fund. It's an asset allocation fund. No index follows the design methodology of having a Canadian home country bias (more on that later).

What Is XEQT Good For?

A fund like this is an excellent choice for retirement savings or other target-date scenarios, such as education savings. They're approved to be held in non-registered (cash) trading accounts and registered accounts such as RRSPs, LIRAs, RDSPs, TFSAs, RESPs, and RIFs/LIFs.

However, reading the asset location section below would be best to understand the minimal impact of holding a fund like this in your chosen account.

What Does XEQT Invest In?

XEQT invests in Canadian stocks, U.S. stocks, EAFE (Europe, Australasia, and the Far East) and EM (Emerging Markets). The target allocations to these markets are 25%, 45%, 25%, and 5% respectively.

XEQT invests in all market caps: small, mid and large. This helps avoid the concentration in large caps that many investors have.

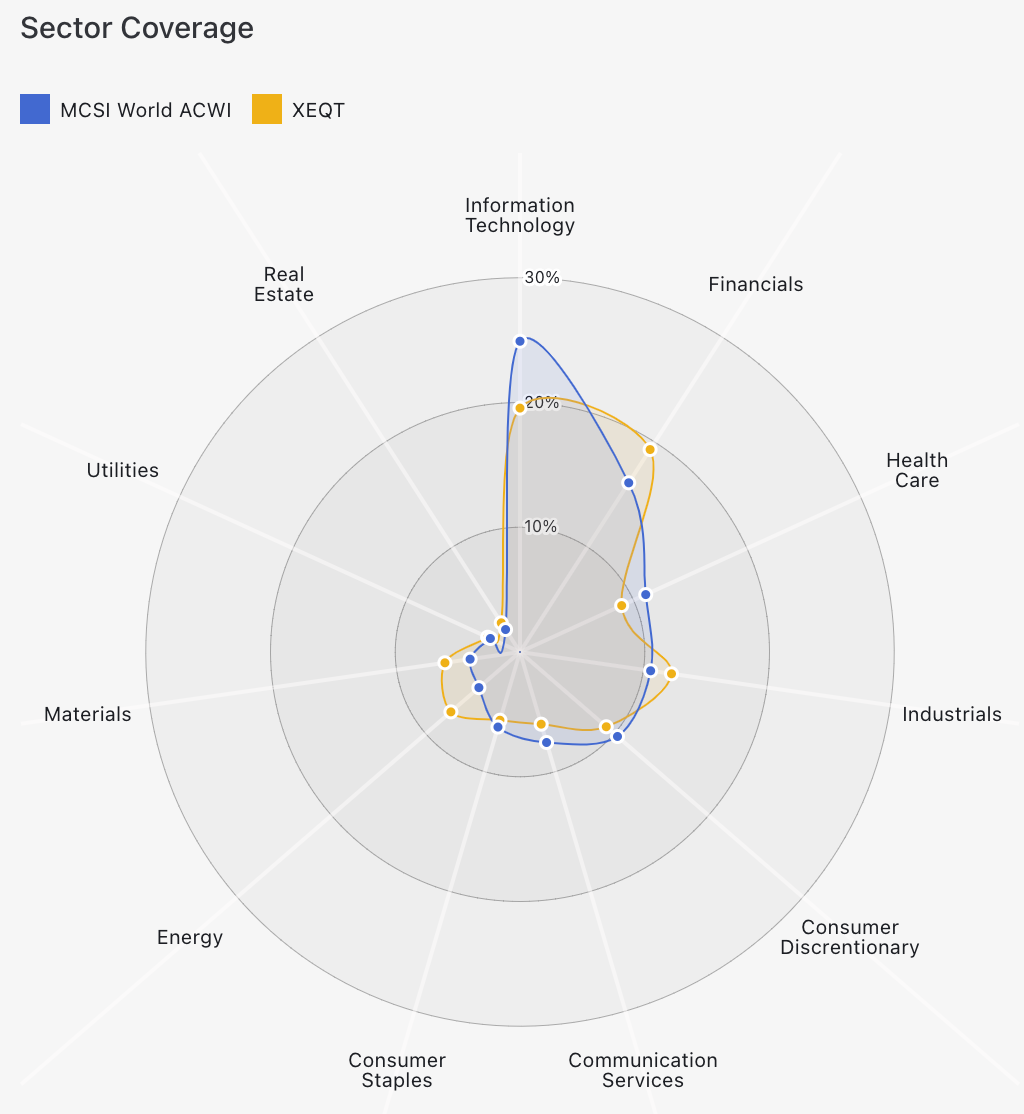

The fund also has reasonably good sector coverage, although the obvious heavyweights of financials and technology are well represented. Below are its sector weightings versus the MSCI World ACWI index.

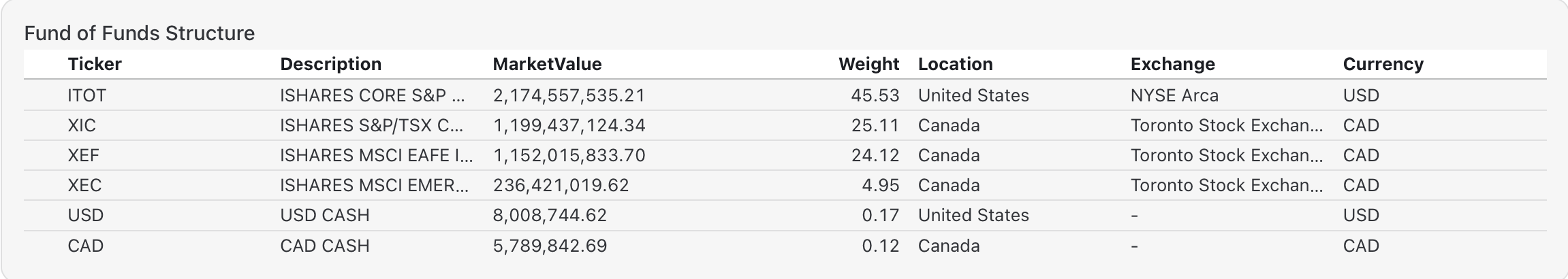

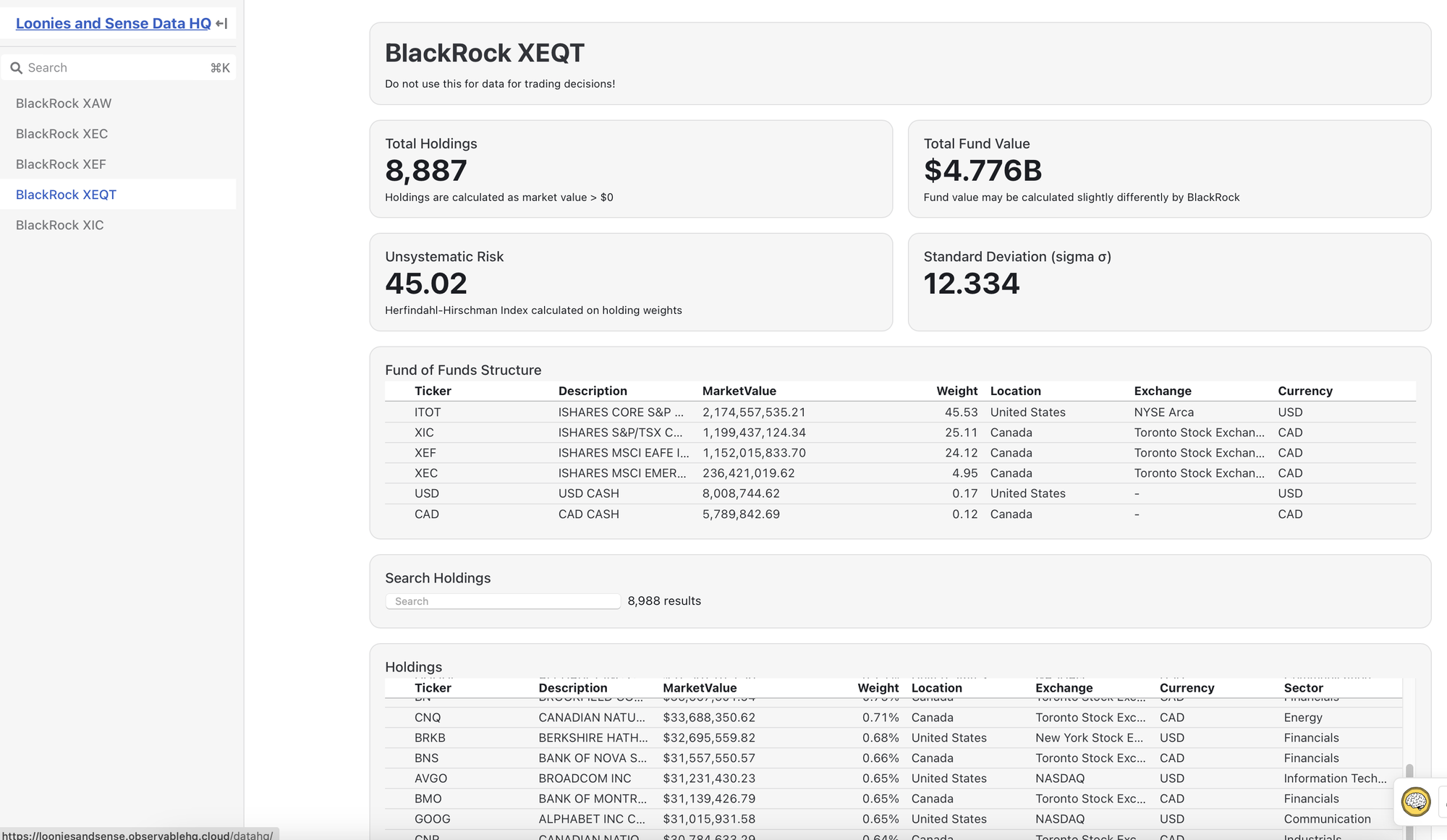

Fund of Funds Structure

XEQT is structured as a "fund-of-funds." Instead of holding ~9,000 equities directly, the fund comprises other BlackRock funds that hold the equities. BlackRock owns funds that invest in the total U.S. market, the entire capped TSX/Composite, EAFE, and Emerging Markes. They've taken those funds and used them as the foundation for XEQT.

The difference is that instead of weighing XIC, the Canadian fund, at ~3%, they chose a 25% allocation. The U.S. has a 45% allocation, EAFE 25%, and EM 5%.

The fund-of-funds structure has no downside. Fund managers can provide an economy of scale by using their other funds as "building blocks".

Instant Diversification

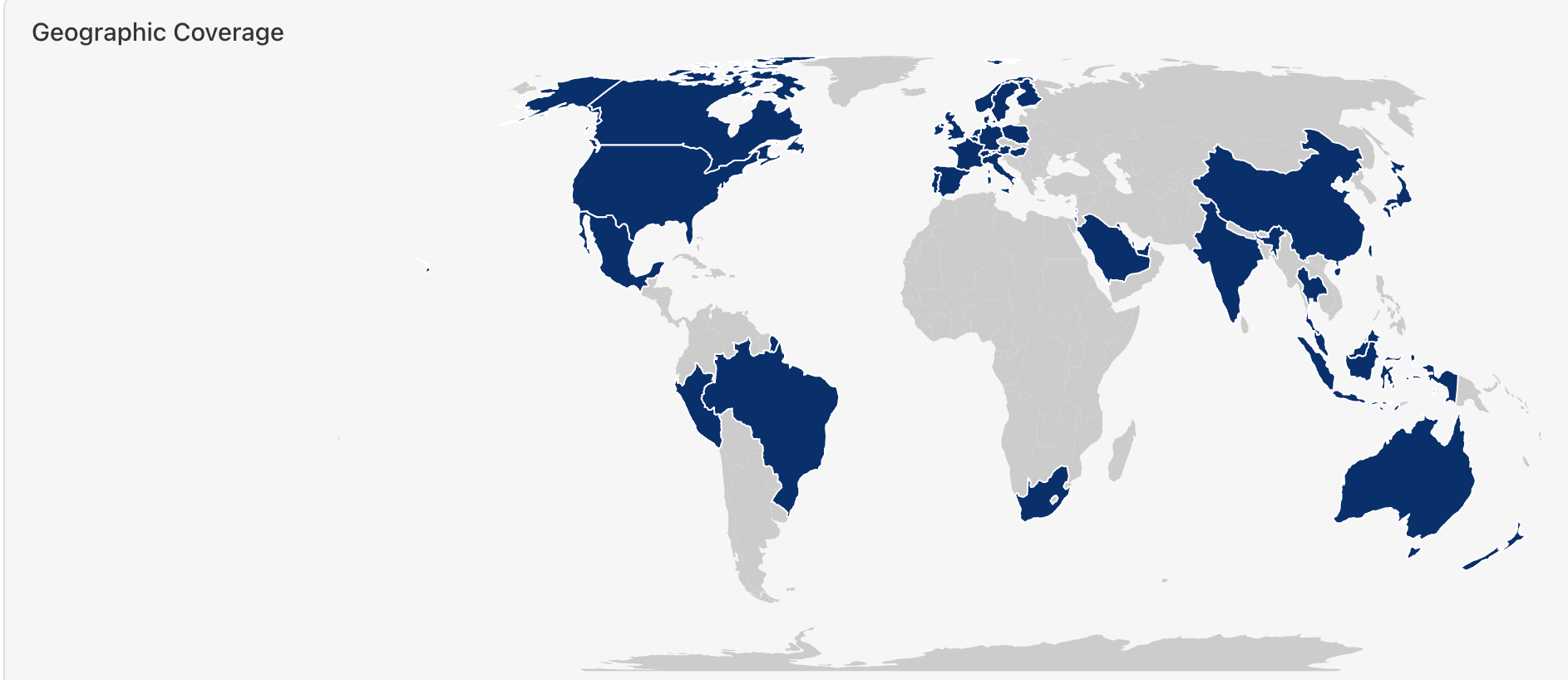

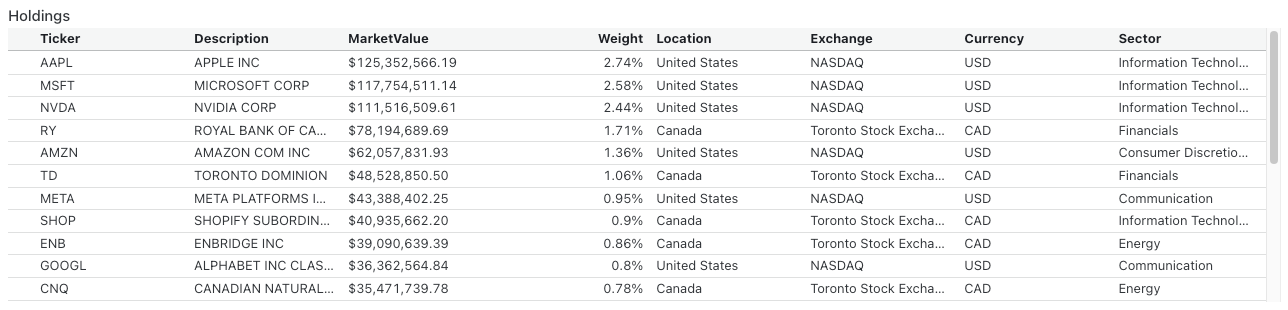

XEQT invests globally and employs massive diversification. As mentioned, it currently holds around 9,000 equities in 49 markets.

The positions are relatively market-cap-weighted, though. You're not taking every $1 investment and buying $1/9000 of each stock.

With cap-weighting, larger companies like Apple and Microsoft are more represented in the fund based on their market capitalization, meaning your investment in XEQT will grow along with these global giants.

While cap-weighting isn't perfect, it does tend to yield reasonable results over long periods. And I can point to some fancier factor funds that underperform simple cap-weighting in global equities.

Some people counter that the massive diversification of these funds means you own tiny positions in thousands of stocks. But also remember that you capture all the alpha from small companies as they grow. Remember when the S&P 500 voted to admit TSLA? TSLA had already returned around 400% at that point. You would have captured all that alpha with a fund like XEQT with the next TSLA.

One way I like to position funds like this is that you capture an approximation of humankind's total economic output. At the same time, you are never putting all your eggs in one basket.

Low Cost

You may be familiar with using MER to gauge the cost of running an ETF, but MER is not the total cost to you as an investor. There are trading costs (Trading Expense Ratio or TER) that affect your returns, so they should also be considered. TER should not be confused with the Total Expense Ratio, which is often used in Europe as a more thorough disclosure of what an ETF costs an investor.

At a total cost of 0.21% (MER + TER), XEQT offers one of the most cost-effective ways for Canadians to access global markets without the hassle of managing multiple investments or rebalancing.

Regarding XEQT being a "fund-of-funds", you do not pay fees on the underlying funds. The costs you see above are the only thing you pay.

Another way to look at fees is what a specific portfolio size costs to run on an annual basis:

$100,000 holding in XEQT * 0.21% fees = $210 per year

I would caution those who think they can save a few dollars by buying the underlying funds. In my experience, many folks won't rebalance (including selling their winners). Removing yourself from the equation is a good thing.

Automatic Rebalancing

Automatic rebalancing means you don’t need to worry about regularly adjusting your portfolio. The fund manager does this for you, keeping your investments in line with the target allocations so you can stay focused on long-term growth.

Over time, the target allocations (25% Canada, 45% U.S., 25% EAFE, 5% EM) of XEQT will drift. The underlying securities in one part of the world (recently, the U.S.) may push that proportion of the fund out of balance. Additionally, the underlying currencies of the holdings also come into play because holdings are in foreign currency converted back to CAD.

When an allocation is out by more than 10%, the fund actively rebalances. So, for example, if Canada goes beyond 27.5% (25% * 10% = 2.5% plus the target of 25%), they'll rebalance.

Because XEQT is rapidly growing, there's no need to rebalance actively. The fund manager rebalances using the inflows of new investment dollars.

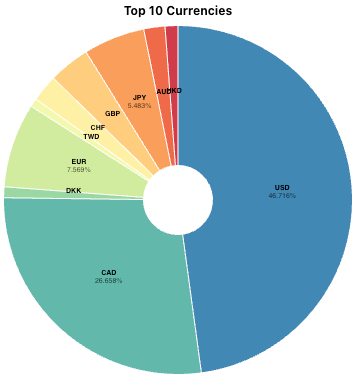

A Basket of Currencies

A considerable benefit of global asset allocation funds is that they expose you to a basket of currencies without requiring you to hold assets directly in different currencies.

XEQT currently holds 38 currencies. Out of every dollar you invest, about $0.46 buys USD assets, $0.26 goes into CAD, $0.075 into EUR, and $0.055 into JPY.

Holding a basket of currencies boosts your portfolio if CAD loses ground because the underlying assets become strong in CAD terms. You're, in essence, hedging your future.

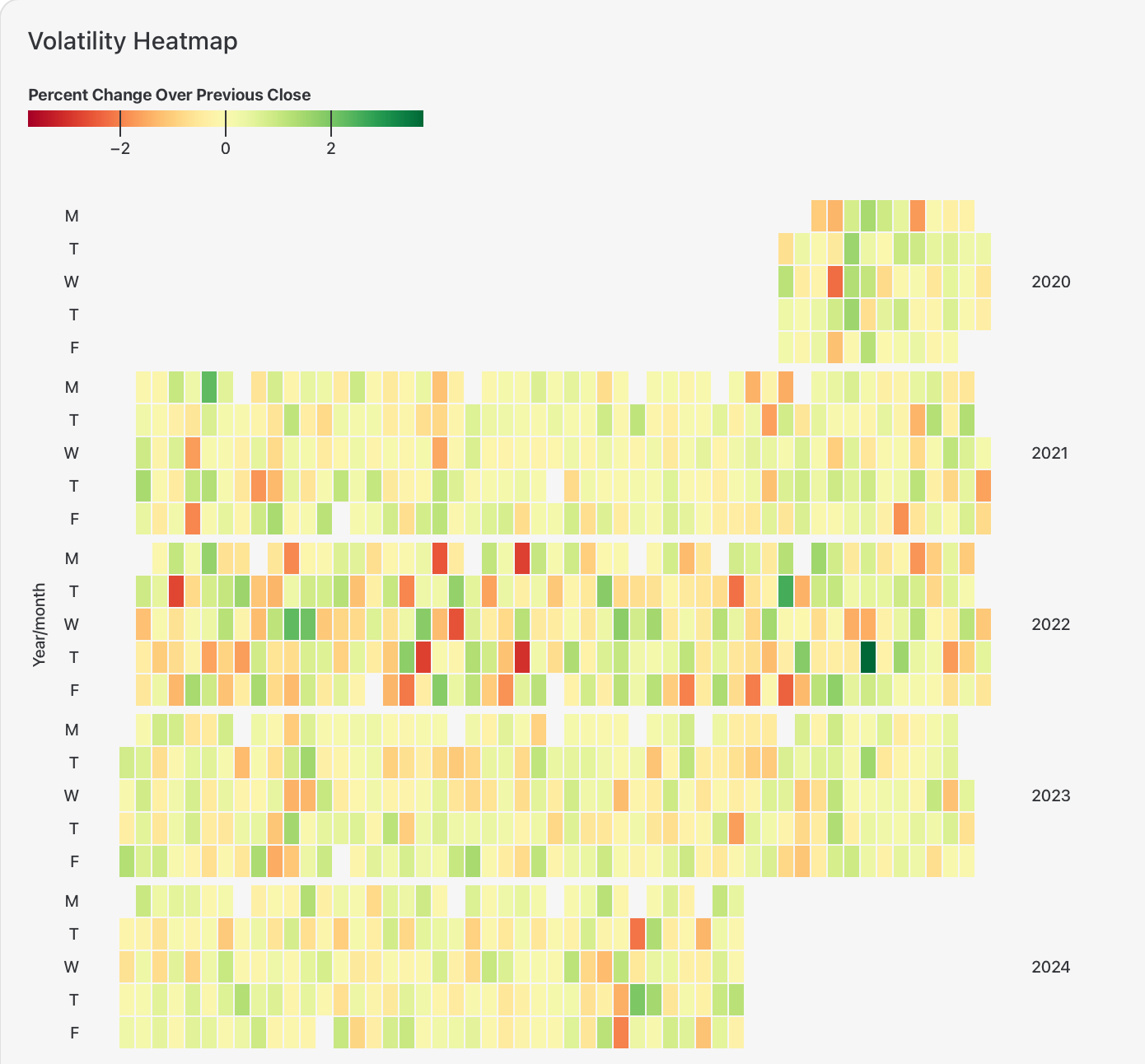

Low Volatility

One benefit of a fund like XEQT is its relatively low volatility. Since its inception, even with the pandemic, the fund's standard deviation has been ~15.8%.

Volatility becomes increasingly important if you're in decumulation and want to hold equities in retirement. Volatility feeds sequence of returns risk—lower is better in retirement.

A Bit of Home Country Bias Is Generally Good

XEQT has a target allocation of 25% to Canadian equities. Canada is roughly 3% of the global "investible" stock market at the time of writing, so this might seem "overweight" to some.

However, research studies suggest that some home country bias is not just okay; it's good.

You want to anchor your portfolio in the currency you will be spending. For most Canadians, that's likely to be CAD. If you weighted your Canadian allocation in your portfolio at only ~3%, you would find that you have 97% of your portfolio in a currency other than the Canadian dollar. Shifts in foreign currency might buoy your portfolio but can also hurt it.

If you read my post about moving to Costa Rica, you'll note that we would have had a lifestyle cut of ~24% due to the appreciation of CRC against CAD. That was a 24% currency shift in only three years.

You Invest to Maximize Returns Without Undue Risk

Many people erroneously think you invest for the best returns. But you invest to maximize returns without undue risk.

You get good risk-adjusted returns by not concentrating your portfolio in one market, one currency, one market cap size, or even one sector. Based on my observations, funds like XEQT outperform a lot of stock pickers. While they may pick some winners, the losers act as a drag on their performance.

The other challenge with "best returns" is you're not clairvoyant. Most people choose investments based on past performance or limited information, such as quarterly reports. This is like looking in your rear-view mirror while trying to drive forward and then wondering why you crashed.

Also, as Morgan Housel says:

You can be an extraordinary investor by earning average returns for an above-average period of time.

— Morgan Housel (@morganhousel) July 29, 2024

Time is your best asset when it comes to investing. Choose a good investment that sets you up for all eventualities, keep adding to it systematically, and add time.

100% Equities On the Way Up

If you have a long investment horizon, you can likely afford to be 100% global equities while accumulating your nest egg. Some would argue that you can even survive on 100% global equities through retirement, as discussed in the paper "Beyond the Status Quo" a little while back. However, I would also read Cliff Anses' rebuttal of the paper as he has some reasonable points.

Once you reach your target date (closer to an education or retirement goal), you can add fixed income (bonds) if that makes you feel more comfortable. Bonds are an uncorrelated asset (most of the time), so they tend to react to market conditions differently and smooth out your returns. We saw bonds and global equities move downward together in the 2022 drawdown, so there's that disclaimer.

BlackRock's XBB or Vanguard's VLB are solid Canadian bond funds that can help you limit risk toward the target date. If you're doing things on a target-date basis, you likely want to limit yourself to Canadian fixed income to remove currency risk.

I would not blend in the fixed-income variants of BlackRock's or Vanguard's asset allocation funds because you'll keep adding more equities rather than tilting your asset allocation toward bonds. While you could easily swap out your holding for one of these funds in a registered account, see the previous comment about limiting risk on a target-date basis.

Asset Location

Different asset locations (the type of account, i.e. non-registered, RRSP, TFSA) where you hold funds like these make a slight difference in your returns.

Firstly, only dividends/distributions from the underlying assets are affected. There is no tax difference on the capital gains.

Secondly, the "tax drag" only occurs on non-Canadian holdings, the U.S./foreign portion of these funds.

In an RRSP, the U.S. allocation will not have withholding taxes (WHT) on distributions from the ITOT. The U.S.-Canada tax treaty has a provision to remove the WHT in this scenario. But anything foreign distributions will, and the withholding rates are set by whatever jurisdiction the security is held in (and then subject to whatever tax treaty arrangement Canada has with that country). Remember, XEQT has a distribution yield of ~2%. We're discussing a slight "drag" on your returns from foreign withholding taxes.

A TFSA doesn't have the same U.S. tax advantages as an RRSP because the tax treaty does not recognize this type of account. So, the fund's allocations to the U.S. and foreign equities will have their distributions taxed with WHT.

In a non-registered (cash) account, you will have withholding taxes on all U.S. and foreign income that the fund accumulates. However, you can likely claim a credit on your taxes for these taxes, and then the distributions would be factored into your Canadian tax return.

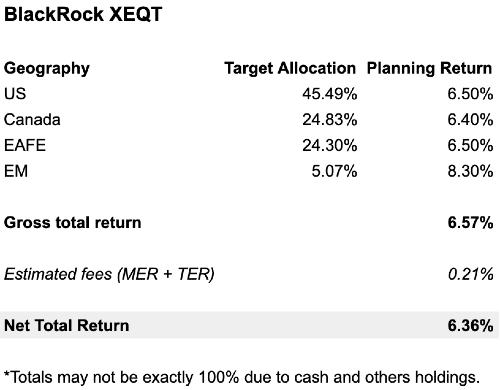

What Returns Should I Plan For?

I recently wrote about returns in this piece.

If you're trying to build your own financial plan, you might want to adopt FP Canada's planning rates. They aim to set reasonable rates of returns for different assets over the next decade. You might do better than the published rates, but the idea is to use something conservative and reasonable.

FP Canada's rates are nominal (i.e. not adjusted for expected inflation) and gross rather than net. In other words, you must remove fees and account for inflation.

I would use a 2.2% figure going forward to adjust for inflation.

Introducing Loonies and Sense Data HQ

I've built a web app for Canadian DIY investors that dives deeper on some popular Canadian ETFs. It's affectionately called "Data HQ". For those interested in XEQT, you can dive deeper on:

- Current XEQT holdings that are searchable

- Risk metrics such as Herfindahl-Hirschman Index, VaR, CVaR, max drawdown, and standard deviations

- Distributions and price history

- Volatility (expressed as a heatmap)

- How XEQT invests geographically

- Underlying XEQT currency holdings

All the data for this article was derived from Data HQ.

You can access it through this link: https://looniesandsense.observablehq.cloud/datahq

It's built using the fantastic Observable Framework and hosted on its cloud platform.

A Few More Words About Taxes

If you examine XEQT's financial statements more deeply, you may notice that it distributes Return of Capital as part of its distribution.

Return on Capital (ROC) can have some negative connotations. It sometimes happens when a fund doesn't have cash flow to pay a distribution. The fund sells some assets to cover the distribution. For example, some "income" funds do this, and their NAV decreases over time.

This is not what's going on with XEQT. It's related to inflows and how they're accounted for in ETFs.

Wrapping Things Up

An ‘all-in-one’ ETF like XEQT bundles many global investments into one simple package, providing instant diversification and exposure to multiple markets. You don’t need to worry about managing multiple investments – this ETF does it for you.

It's not that XEQT is an excellent product in itself; it's that XEQT matches many of the things we look for in financial planning. These include global diversification, exposure to multiple currencies, low risk (for an all-equities approach), reasonable fees, appropriate home country bias, and going beyond large caps.

As mentioned, "all-in-one" ETFs are designed to be your entire portfolio. That said, it's probably okay to have a small allocation to names if that's your desire. But having, say, 5% of your entire portfolio in XEQT misses the point and its benefits.

While asset location (type of account) does matter a little bit, it shouldn't be a deciding factor. Your most significant gain is investing systematically over a long period.

Most of all, a simple plan that you can stick to is likely the best, and this fund sets you up nicely for that.

Marc is an advice-only financial planner. He helps DIY investors "fill in the gaps" with retirement planning, tax planning, estates, risk mitigation, and more. You can read more about that here.

Marc owns the security mentioned in this post in his portfolio (BlackRock's XEQT).

While every effort is made to ensure this information is complete and accurate, it is not advice, and you should talk to a professional about your circumstances.